Introduction to MiF at EDHEC

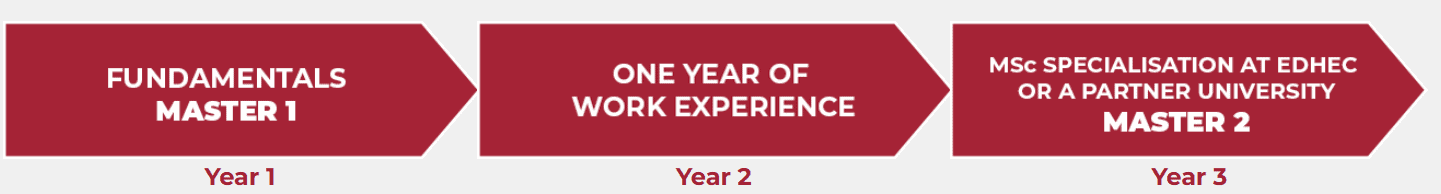

This is a two-year academic programme, taught entirely in English. It will provide you with the knowledge and skills you need to pursue an international career in finance.

This flagship EDHEC Master in Management ‒ Finance programme awards graduate students and young professionals a double degree: a Master in Management and a Master of Science. Incorporating a full year of professional immersion and/or academic exchanges, the programme benefits from EDHEC’s close ties with leading companies, corporate sponsors, and academic partners: the CFA Institute, the Global Association of Risk Professionals (GARP), Mazars, PwC, MINES Paris-PSL, Amundi, Crédit Agricole Nord de France, CA CIB and Société Générale.

700+

Avg. GMAT

23

Avg. Age

2+ Yrs.

Avg. Exp.

21

Class Size

16

Months Duration

Quick Overview and Rankings

5

FT Rankings

23

QS Top MIF

Tuition Fees & Scholarship at EDHEC

€ 26,400

Tuition Fee

+

€ 24,300

Living Cost

Avg. Cost of Study

The Tuition fees for EDHEC MIF is € 26,400 and an additional € 24,300 in living cost.

As part of its strategic plan to “Impact Future Generations”, EDHEC has committed to enabling talented students to pursue their studies through a diverse and transparent scholarship scheme. The French Ministry of Foreign and European Affairs also offers a large number of grants and scholarships, and there are numerous bodies worldwide supporting the study of international students wishing to embark on a master’s programme.

Important Scholarships

- The EDHEC Academic Excellence Scholarship

- EIFFEL Scholarship

Average Employment Salary after EDHEC MiF

Employed within 3 months of graduation

Avg. Salary

12%

Consulting

8%

Finance

30%

Technology

50%

others

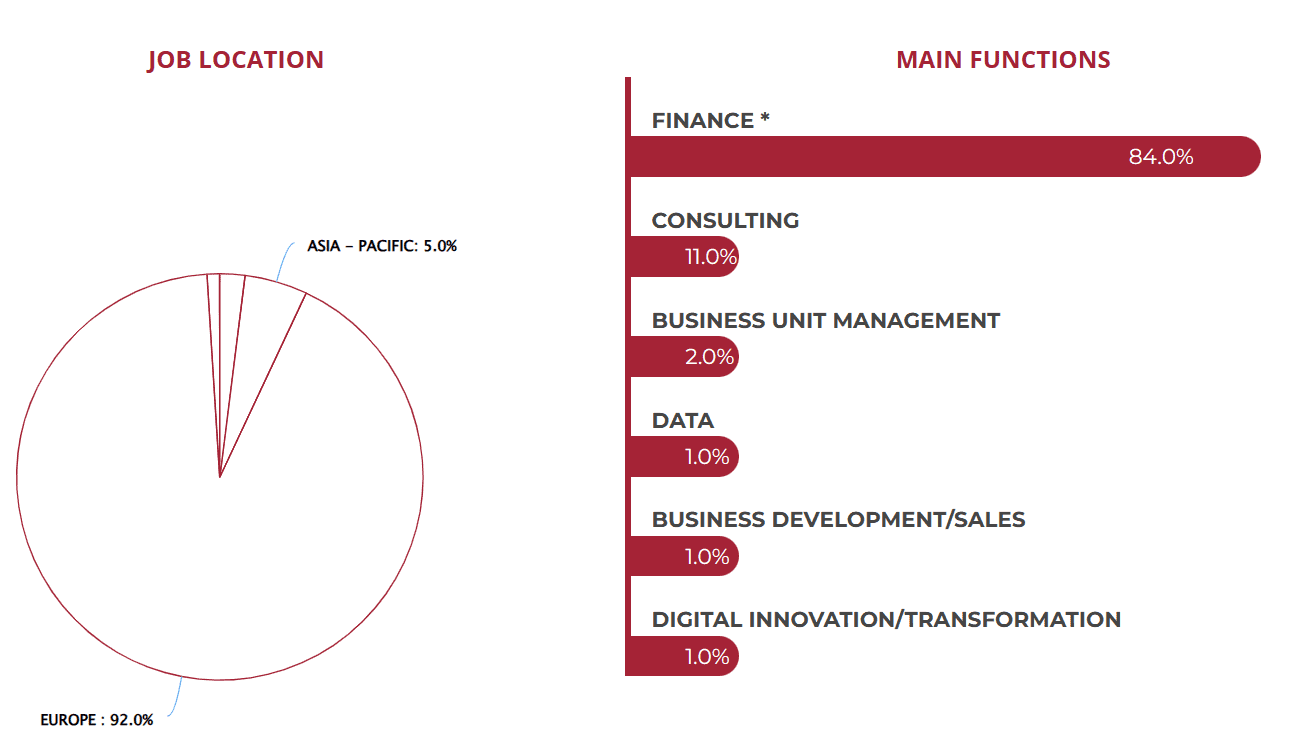

The average salary at EDHEC MIF for the last graduating class was €69,694. 96% of the class was employed with 3 months of graduation with majority of class going into consulting (12%), Finance (8%) and technology (30%) oriented functional roles.

Understanding and developing the attributes and skills employers require is key to employability. This is why the EDHEC Career Centre offers a programme specifically designed to help master’s students map out and achieve their career goals ‒ the EDHEC Career Booster. The programme looks at students’ specific needs, wants and goals when it comes to professional development and matches them to job-market requirements.

Key Employers

- ALLIANZ

- AXA

- ALPHA CAPITAL

- BANK OF AMERICA

- BLOOMBERG

- BNP PARIBAS

Application Requirement

EDHEC seeks talented candidates from diverse backgrounds, with a history of strong academic achievement and demonstrated potential for growth and professional success.

- Minimum three-year bachelor’s degree (any type of engineering or business/finance background)

- Acceptable English proficiency tests/certificates (TOEFL, TOEIC or IELTS)

- TOEFL Internet-based ≥ 92

- TOEIC ≥ 850

- IELTS ≥ 6.5

- Cambridge Test of English > 175

- Strong GMAT or GRE or TAGE MAGE or CAT* official test score report (CAT* for Indian students only) or CFA Level II

Documents Required

- CV

- Letter of motivation

- Academic transcripts

- Two letters of recommendation

Wondering if you can target this school?

Free Profile Evaluation Workshop

Join our live workshop and

Get all your profile related questions answered.

Specializations and Electives Offered

The Master offers a comprehensive approach to financial management, with core modules such as corporate finance and asset markets, climate finance, financial analysis, portfolio construction theory, etc. The programme also gives you the opportunity to choose from a wide range of electives to help you customise your Master, and achieve your professional goal: microfinance, theory of financial crises, country risk analysis…

For detail insights, visit here.

FAQs about MiF at EDHEC

What is the MSc in International Finance in EDHEC?

The MSc in International Finance is an advanced programme designed to equip you with the key corporate finance and financial markets skills you will need to pursue a career in international finance. The programme is specifically designed for graduates and young professionals with prior training in a numerate discipline. You will learn how to assess companies and investments, evaluate portfolio management strategies and master corporate finance decisions. The MSc in International Finance is a CFA Program Partner and will prepare you to sit the CFA Level 1 exam.

How do I get into EDHEC’s MSc in International Finance?

EDHEC seeks talented candidates from diverse backgrounds, with a history of academic achievement and demonstrated potential for growth and professional success, ideally with a primary degree or previous training in a numerate discipline. You will also need to score adequate marks on an English proficiency test unless you are a native English speaker or have completed an undergraduate degree through English.

Can I specialise in a specific area within international finance in EDHEC?

The MSc in International Finance will give you the opportunity to specialise in a specific domain.

You can choose between the Corporate Finance track and the Market Finance track. During the programme you will also complete a master’s project, which will allow you to specialise in any area that interests you.

CAN ONE GET A BANK LOAN IN FRANCE?

Students may also finance the cost of their education with student loans, which typically carry low interest rates and can be paid back following graduation. However, French banks require a guarantor living in France. We suggest that you contact your local bank in your home country. They often have close links to certain banks in France.

At the beginning of each semester for three weeks, various banks come to take part in the Bank Forum organized by HEC Paris to allow you to learn about bank loans, open a French bank account, and compare the exclusive financial benefits offered to HEC students. Over the course of the academic year, BNP Paribas, la Société Générale and LCL have a permanent stand in the RU twice a week; this means you will always be able to get support and information from people who are used to helping international students. You can open a bank account and pick up your card in the same place. Please note that it is compulsory to open a French bank account to get a residence permit and for receiving housing aid.