LSE Application Essays & Questions 2023-2024

- Why are you applying to this program now? What is the professional objective that will guide your career choice after your MIF, and how will the MIF contribute to the achievement of this objective? (500 words)

- What do you consider your most significant life achievement? (250 words)

- and ethics are inevitably intertwined in the business world. Describe a situation in which you have dealt with these issues and how they have influenced you. (250 words)

- Imagine an entirely different life from the one you lead, and what it would be? (250 words)

- What figure do you admire the most and why? (250 words)

LSE Winning Sample Essays – 1

Why are you applying to this program now? What is the professional objective that will guide your career choice after your MIF, and how will the MIF contribute to the achievement of this objective? (500 words)

I am applying to the Master’s in Finance (MIF) program at the London School of Economics (LSE) now because I have reached a pivotal point in my career where advanced financial expertise and a global perspective are essential for achieving my professional objectives. Over the past several years, I have built a solid foundation in finance, gaining substantial experience and achieving significant milestones in roles at Stanbic IBTC Bank and PwC Nigeria. However, to propel my career to the next level and make a meaningful impact in the finance sector, I recognize the need for specialized knowledge and skills that the MIF program offers.

My professional objective is to drive sustainable growth and development in the energy sector by leveraging innovative financial solutions. In the next 3-5 years, I aim to join a leading investment bank’s energy group or a private equity firm focused on sustainable energy projects. These roles will allow me to develop and implement advanced financial models for pricing, risk management, and investment strategies, particularly in the context of renewable energy projects and sustainable infrastructure development. My long-term goal is to establish a climate-adaptive energy fund dedicated to ensuring access to safer, cleaner, and sustainable energy sources across Sub-Saharan Africa.

The MIF program at LSE is uniquely positioned to help me achieve these objectives. The program’s rigorous curriculum, which includes courses on advanced financial concepts, quantitative methods, and sustainable finance, will equip me with the technical knowledge and practical skills needed to excel in high-impact finance roles. Courses such as Financial Risk Analysis and Sustainable Finance will be particularly valuable, providing insights into managing financial risks and developing sustainable investment strategies.

Moreover, LSE’s emphasis on real-world applications and experiential learning will enable me to apply theoretical concepts to practical scenarios. The program’s strong connections with the finance industry and opportunities for internships and industry projects will provide hands-on experience and enhance my understanding of global financial markets. This practical exposure is crucial for developing the expertise needed to drive sustainable energy projects and attract international investments.

Networking is another key aspect of the MIF program that will contribute to my professional growth. LSE’s global reputation and its location in London, a major financial hub, offer exceptional opportunities for building a strong professional network. Engaging with classmates, alumni, faculty, and industry leaders will allow me to gain valuable insights, mentorship, and opportunities for collaboration. These interactions will be invaluable for identifying potential career opportunities and staying abreast of the latest trends and developments in the finance and energy sectors.

Furthermore, the diverse and dynamic environment at LSE will broaden my perspectives and enhance my ability to navigate complex global challenges. Learning alongside peers from diverse backgrounds and cultures will foster a deeper understanding of different markets and regulatory environments, which is essential for achieving my long-term goals.

In summary, applying to the MIF program at LSE now aligns with my career aspirations and the need for advanced financial expertise and a global perspective. The program will provide the technical knowledge, practical experience, and professional network necessary to achieve my objective of driving sustainable growth and development in the energy sector, ultimately contributing to a more sustainable and equitable future.

What do you consider your most significant life achievement? (250 words)

My most significant life achievement is founding Grief and Relief Nigeria, an organization dedicated to supporting individuals facing grief, domestic violence, and trauma. This initiative was born out of personal tragedy when my mother passed away due to inadequate healthcare. Her death deeply affected me and motivated me to make a meaningful impact on the lives of others who are struggling with similar issues.

Establishing Grief and Relief Nigeria has been a transformative experience. Starting with a small team of dedicated volunteers, we have grown into a community organization that provides critical support services to over 200 individuals. We have raised over $75,000 to fund therapy, mental health support, and medical assistance for those in need. Our efforts include organizing impactful events, such as “Sexual Abuse Awareness” campaigns and HIV awareness drives, which have reached hundreds of people and provided them with essential resources and support.

This achievement is significant not only because of the positive impact it has had on the lives of many individuals but also because it represents my ability to turn personal adversity into a force for good. It has taught me the importance of resilience, empathy, and leadership. Leading this organization has honed my skills in project management, fundraising, and community engagement, which are invaluable in both my personal and professional life.

Grief and Relief Nigeria stands as a testament to my commitment to social impact and my belief in the power of community support and advocacy to drive meaningful change.

Leadership and ethics are inevitably intertwined in the business world. Describe a situation in which you have dealt with these issues and how they have influenced you. (250 words)

One situation where I dealt with leadership and ethics intertwined was during my tenure at Stanbic IBTC Bank. I was leading a project to develop a digital pricing template for calculating expected returns on investments for our clients in the oil and gas sector. This project had significant financial implications and required utmost accuracy and transparency.

During the development phase, I discovered discrepancies in the data provided by a vendor. The inaccuracies could have led to erroneous pricing models, potentially harming our clients’ financial decisions and the bank’s reputation. As the project lead, I faced an ethical dilemma: proceed with the project using the flawed data to meet the deadline or halt the project to address the discrepancies, risking delays and potential financial losses.

I chose to halt the project and investigate the discrepancies. This decision required strong leadership and ethical integrity, as I had to convince senior management and stakeholders of the importance of accuracy and transparency over immediate financial gains. I coordinated with the vendor to rectify the errors and implemented stricter data validation processes to prevent future issues.

This experience reinforced the importance of ethical leadership in maintaining trust and integrity in business. It taught me that making ethical decisions, even under pressure, is crucial for long-term success and sustainability. By prioritizing accuracy and transparency, I ensured that our clients received reliable financial advice, thereby safeguarding the bank’s reputation and fostering trust with our stakeholders.

Imagine an entirely different life from the one you lead, and what it would be? (250 words)

Imagining an entirely different life from the one I lead, I envision myself as an environmental scientist dedicated to wildlife conservation. Growing up, I was always fascinated by nature and wildlife, often spending hours exploring the natural landscapes around my home. In this alternate life, I pursued my passion for the environment through academic studies in ecology and environmental science.

As an environmental scientist, my daily work would involve conducting field research in diverse ecosystems, studying the impact of human activities on wildlife, and developing strategies to protect endangered species. I would collaborate with conservation organizations, government agencies, and local communities to implement sustainable practices that preserve natural habitats and promote biodiversity.

In this role, I would also focus on raising public awareness about environmental issues through educational programs and advocacy. Hosting workshops, writing articles, and speaking at conferences would be integral parts of my efforts to inspire others to take action for the environment. My work would not only aim to protect wildlife but also to highlight the interconnectedness of all living beings and the importance of maintaining a healthy planet.

This alternative life reflects my deep-rooted passion for nature and my desire to contribute to the preservation of our planet. Although my current career in finance and social impact is fulfilling, imagining a life dedicated to environmental conservation allows me to explore another facet of my interests and underscores the importance of integrating sustainability into all aspects of our lives.

What figure do you admire the most and why? (250 words)

The figure I admire the most is Dr. Wangari Maathai, a Kenyan environmental and political activist, and the first African woman to receive the Nobel Peace Prize. Her life and work are a testament to the power of resilience, vision, and unwavering commitment to positive change.

Dr. Maathai founded the Green Belt Movement in 1977, an environmental organization focused on tree planting, environmental conservation, and women’s rights. Through this initiative, she mobilized thousands of women to plant over 30 million trees across Kenya, combating deforestation, restoring ecosystems, and improving the livelihoods of rural communities. Her work addressed not only environmental degradation but also social and economic issues, empowering women and fostering sustainable development.

What I find most admirable about Dr. Maathai is her courage and determination in the face of adversity. She faced significant opposition from political leaders and endured arrests, harassment, and violence. Despite these challenges, she remained steadfast in her mission, using her voice to advocate for environmental sustainability, democracy, and human rights. Her ability to connect environmental issues with broader social and political contexts highlights her visionary leadership.

Dr. Maathai’s holistic approach to addressing complex issues and her relentless pursuit of justice inspire me deeply. She demonstrated that one person’s commitment to a cause can spark a movement and create lasting change. Her legacy continues to influence my own commitment to social impact and sustainability, reminding me of the importance of resilience, integrity, and the power of collective action.

Quick Essay Review

Worried if your Essay is Good enough or Not?

Need a last-minute review?

Submit your essays below & get in-depth feedback within 48 Hours.

LSE Winning Sample Essays – 2

Why are you applying to this program now? What is the professional objective that will guide your career choice after your MIF, and how will the MIF contribute to the achievement of this objective? (500 words)

I am applying to the LSE MIF program at this crucial juncture in my career because I am poised to transition from operational roles in private equity to strategic and leadership positions that influence investment decisions on a global scale. The LSE MIF stands out due to its strong focus on global financial markets, integration of cutting-edge financial technology, and its commitment to fostering a deep understanding of the economic, social, and political influences on finance. This aligns perfectly with my professional objective to become a leader in sustainable finance, focusing on investments that are not only profitable but also beneficial to society.

After my MIF, I aim to lead a division within a top-tier financial institution that specializes in sustainable investment solutions, developing strategies that integrate environmental, social, and governance (ESG) criteria into investment decisions. The urgency of addressing climate change and promoting social equity through finance is clear, and I am dedicated to being at the forefront of this movement.

The LSE MIF will equip me with the necessary tools to achieve these goals through its rigorous academic curriculum and practical market exposure. Courses on international finance, corporate strategy, and sustainable investing will provide me with a robust theoretical framework and analytical skills. Furthermore, LSE’s emphasis on empirical research methods will enhance my ability to conduct thorough market analyses and evaluate the effectiveness of various investment strategies.

Moreover, LSE’s global alumni network and industry connections will be invaluable in this transition. The opportunities to interact with leading professionals and like-minded peers will expand my professional network and open up avenues for collaboration and innovation in the field of sustainable finance.

In summary, the LSE MIF program is not merely a continuation of my education but a strategic step towards realizing my ambition to pioneer responsible investment practices that contribute positively to global challenges. The timing is critical as the financial industry is at a pivotal point where integrating sustainability into finance is not just optional but essential.

What do you consider your most significant life achievement? (250 words)

My most significant life achievement is successfully leading a cross-border investment deal for my company, which not only resulted in a $50 million profit but also established a sustainable energy project in Southeast Asia. This complex deal required meticulous coordination between multiple stakeholders across different countries, extensive due diligence, and innovative financial structuring to address various legal and economic challenges.The success of this project under my leadership not only demonstrated my capabilities in handling high-stakes international finance but also solidified my commitment to sustainable investment. The project has since provided thousands of households with access to clean energy, significantly reducing carbon emissions and demonstrating the potential of integrating profitability with environmental sustainability

This achievement is particularly significant as it encapsulates my professional and personal values: achieving excellence in finance while making a positive impact on society. It stands as a testament to my belief that financial expertise can and should be used to address pressing global challenges.

Leadership and ethics are inevitably intertwined in the business world. Describe a situation in which you have dealt with these issues and how they have influenced you. (250 words)

During my tenure at EPIC Investment Partners, I faced a significant ethical dilemma when I discovered discrepancies in the environmental reports of a potential investment. The project promised high returns, but failing to address these discrepancies would compromise our ethical standards.

I decided to confront the issue head-on by initiating a thorough re-evaluation of the project, which delayed the investment decision but ensured full compliance with environmental standards. This decision was challenging as it risked potential returns and tested my leadership under pressure.

This experience profoundly influenced my professional philosophy; it reinforced my commitment to ethical leadership and integrity in finance. It taught me that true leadership involves making difficult decisions that may not always align with short-term gains but are crucial for long-term sustainability and trust.

This incident has shaped my approach to leadership, emphasizing transparency, accountability, and ethical decision-making as the cornerstones of effective management.

What figure do you admire the most and why? (250 words)

The figure I admire most is Nelson Mandela, for his unwavering commitment to justice, equality, and human rights. Mandela’s ability to forgive and seek reconciliation after years of imprisonment exemplifies a profound strength of character and dedication to his principles.

His leadership in dismantling apartheid and fostering national reconciliation in South Africa demonstrates the power of ethical leadership and the impact it can have on a country’s history. Mandela’s life reminds me of the importance of resilience, integrity, and the pursuit of a greater good beyond one’s own interests, principles that I strive to embody in my own life and career.

LSE Recommendation Letter – Key Questions

- Please provide details about the cohort to which you are comparing the applicant (e.g. students in a particular course, degree program, year group, taught/supervised in last 5 years, other employees at a similar stage in their career) and the size of this cohort

- What is your assessment of this applicant’s suitability for their chosen program(s)?

- What is your overall level of recommendation for this applicant?

MiF Recommendation Letters

(Free Samples & successful Examples)

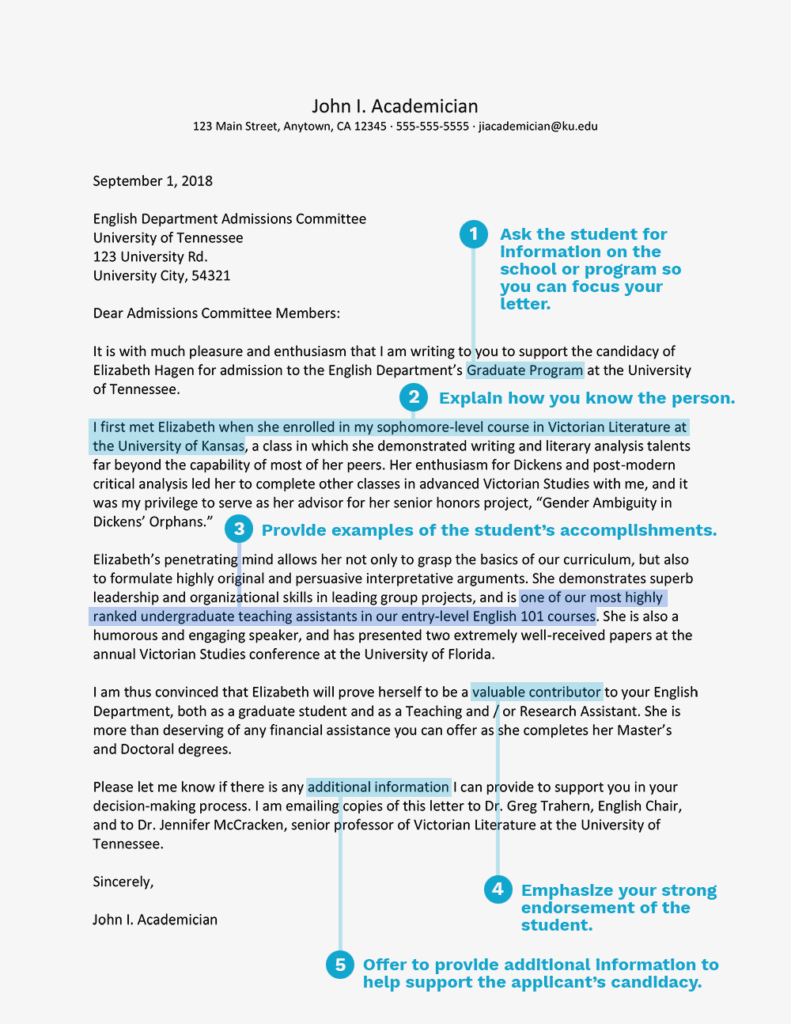

Professor - Recommendation letter Sample 1

Here is a quick PDF of a sample recommendation our client submitted for a successful admit.

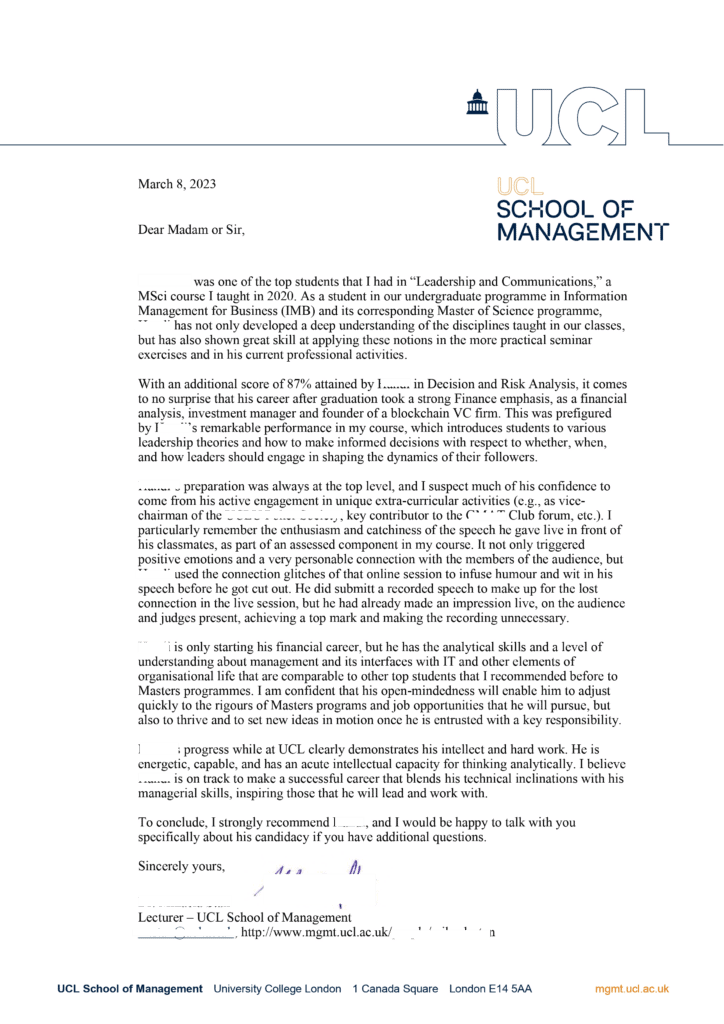

Professor - Recommendation letter Sample 2

To,

Admissions Committee

HEC Paris – Masters in Finance Program

Date: 08-09-2023

Subject: “Recommendation letter for Akhil’s application to MIF program at HEC Paris”

Dear Admissions Committee,

I have known Akhil for over 2 years now. He was a student in my Entrepreneurship course as part of his Minor in Entrepreneurship and Management. As a student in my class, Akhil showed great skill at applying these notions in the more practical in-class quizzes, his final group business pitch at the end of the course, and his professional activities at UBS. Akhil’s also had a remarkable performance in my course, in which Akhil got the highest grade possible of A+.

In terms of his potential,

Akhil stood out to me in the final project that I gave as part of the course evaluation. As a major assessment, I give a project assignment for students to work in groups and pitch a good, self-sustaining business idea.

Akhil took the initiative and created a multicultural and diverse team with students not only from different countries but also students from different majors and successfully delivered a group business pitch for a student-run laundry and cleaning business. The idea picked by his team was unique, and he actively sought my advice and mentorship to make the team and the project successful.

Another noteworthy facet is the analytical research done by Akhil before and after seeking my advice; he actively made an effort to learn about diverse topics that he had not been exposed to before and was successfully able to learn about the different aspects of entrepreneurship, such as management and finance. Demonstrating his goal and detail-oriented ability. Rhe idea, the data oriented research, and the financial analysis were really impressive (synthesized and executed on assigned taks). Also, the real-world considerations regarding the execution of the pitch, as well as the cohesive delivery from a team collaboration perspective, were good.

I liked the project, and I asked Akhil if I could include the pitch and presentation as teaching material for my course as well as offering a Research Assistant position to Akhil in the next summer, which he was unable to take due to him having graduated

With his analytical skills and his collaborative approach, it came to me as no surprise that he was able to successfully chase his goal and transition into finance directly from his undergrad in engineering, landing a role in finance with UBS in their Investment Banking Operations in Hong Kong.

In terms of his potential areas of Improvement

I think Akhil’s analytical nature and detail-orientedness sometimes leads to him getting too caught up in details and spending excess time on the intricate details, leading to improper time management.

In the group project, Akhil struggled with time management and was a week behind schedule for his group due to him giving equal attention to all the details of the presentation, losing track of the bigger picture of the project. With my guidance, he was able to get back on speed and submitted the project by the submission deadline. But I believe that Akhil needs to work on gaining a view of the overall project that he is working for better time management.

Overall Recommendation

Akhil is only starting his financial career, but he has the analytical skills and a level of understanding about management, teamwork and other elements of organizational life that are comparable to other top students that I recommended before to Masters programs.

Akhil’s progress at CityU and at UBS clearly demonstrates his intellect and hard work. He is capable and has an acute intellectual capacity for thinking analytically. I believe Akhil is on track to make a successful career that blends his quantitative inclinations with his qualititaive skills, inspiring those that he will lead and work with.

To conclude, I strongly recommend Akhil, and I would be happy to talk with you specifically about his candidacy if you have additional questions.

Regards

Professor XXXXXX

Head of the Department of Entrepreneurship and Management

XXXX University

Internship Manager - Recommendation Letter Sample 1

How long and in what capacity have you known the candidate?

I have known Pranav for roughly one and a half years. I was his mentor during his internship with UBS. Although he completed his internship and has moved on, we still continue to keep in touch to exchange different business ideas.

What do you think about the candidate’s professional performance and potential (including any room for improvement)?

When Pranav started his internship with UBS, he was one of the most proactive interns. Since he didn’t have a finance background, he showed keen interest in learning and came up the curve very quickly.

The team assigned him Automation and Efficiency-related projects, and while working in the automation team he managed to stand out from other interns by providing solutions that were slightly outside of the box and impressed everyone on the team.

For instance, he met with various team leads to understand their automation requirements and one team lead expressed her frustration with the manual risk report that used to take 10-12 hours every quarter. After the meeting, Pranav took the proactive step of helping automate this report for the team. The specific process automation that he implemented was for risk reports for the risk team. The team had a manual time consuming process in which they had to refer to multiple Excel sheets to create their quarterly risk report. Pranav understood and mapped the entire process before using an automation tool to automate it. This led to a time reduction of 90 percent in the compilation of the report. The automation process he designed was ingenious; no one had thought of using it before, and that is why I think everyone was impressed with his out-of-the-box thinking.

Apart from that, another one of his biggest strengths is his willingness to take initiative.

To highlight another instance, he noticed the dashboards in Operations and wider UBS were on Tableau, he took the initiative to compare Tableau and PowerBi and pitched shifting the employee statistics dashboard to PowerBi. The management team agreed and Pranav successfully created an Employee demographic dashboard on PowerBi. This led to cost savings for the department as UBS was already paying for PowerBi. He also took even more initiative, helping others in his team and UBS get certified on PowerBi and documented his knowledge for everyone before he left his internship.

On the flip side, when it comes to areas of improvement, I would also say this proactiveness and eagerness sometimes led to difficult situations. Like other fresh hires, he was also trying to prove himself in the initial months of his tenure with the team. However, this often meant that he would try to manage and solve things on his own instead of seeking help. This led to delays and situations becoming critical.

Pranav was tasked with getting certified on Automation Anywhere, another automation tool used by the team. He was unable to crack the certification according to the timeline assigned to him and was delayed by a month in getting certified. He tried to manage and solve the situation but was unable to do so without help from his team, this delay led to an increased workload for the rest of the team and longer hours as work had been earmarked for Pranav to do as soon as he would be finished with the certification.

Overall, I would say that Pranav has great potential; he is not afraid to take the initiative and present his ideas.

Regards

XXXXXX

Manager – UBS, Hong Kong Offices

Internship Manager - Recommendation Letter Sample 2

How do you know the applicant? How long have you known them for?

I have known Huang for almost 2 years now.

I came to know Huang when he was working at Chainfir Capital. I was an investor of the fund at Chainfir Capital. Huang worked as an investment manager at Chainfir and we had meetings together from time to time.

Later when Huang and his colleagues decided to start their own Venture Capital fund (Genesis 22) focused on crypto industry, I joined their venture both as an investor and an advisor of their VC Fund.

What would you say are the applicant’s key strengths and talents?

After working with Huang, I think one of his key talents is that he is very detail oriented and loves to perform extensive due diligence.

For instance, Genesis 22 was close to making an investment decision on a project called Glitter Finance last year. At the time, it was a rather popular project among VCs and had already received several investments. The analyst in our team provided positive comments on its technology and future potential.

Huang was responsible for speaking with the project team and conducting due diligence. He was able to approach the situation with a sceptical mind and later identified several risks of the project by paying attention to each detail. He made an analysis of the profile of each team member of the project and determined that the technical background of the team was not strong enough to develop the promising highly technical project they claimed. Also, he mentioned that while observing all the interaction between the founder of the project and individual investors in the community group, he noticed that the founder often gets angry easily when facing tough questions.

He raised these concerns during the investment decision meeting, and at the end of the meeting, we decided not to invest. A few months later – the project went bust because the value of the project was way inflated and every institutional investor suffered a loss. I am glad that Huang was able to pay close attention to such details and has always worked with great attention to achieve better performance.

Another key talent of Huang is his multi-tasking skills. I am really impressed by his performance in dealing with a variety of projects simultaneously. When he works as an investment manager in the team, he needs to handle the communication and investigation with 5-8 projects at the same time. He has never left others waiting for his work, and we can always set up the evaluation meeting in the anticipated time frame. He is also able to deal with the pressure when there are extra projects which need his attention.

What would you say are the applicant’s key weaknesses or areas for improvement?

As the founder of a venture capital firm, Huang has built a team and became a leader at such a young age. But I think there is still room for improvement in his management skills, especially in delegating workload.

As Huang prefers to participate in every stage of the investment decision of a certain project, it limits the overall number of projects he can oversee. For example, he spent much time on initial screening and understanding complex technology concepts of different projects. In my opinion, he could delegate this work and trust his colleagues to complete these tasks as our analysts with technology backgrounds are capable of determining the technology feasibility so that he can invest most of his time in reviewing the big picture.

Second thing I have asked him to improve upon is that he can sometimes be over-optimistic and confident when things are going well. From my perspective, it is crucial to keep a cool mind when dealing with different market situations. When he started Genesis 22, several investments that we made looked promising. Consequently, he was on the aggressive side to allocate a higher proportion of the fund to such projects. However, when there was a change in the market trend and crypto industry started crashing, some investments did not perform as well as we expected. The fund suffered extra losses because of the higher allocation made to these investments.

Huang realized his mistake afterwards and became more cautious in making an allocation to investments to improve the diversification of the portfolio. I hope he has learned his lesson and does not repeat the same mistake again.

In which areas of development has the applicant progressed most in the time you’ve known them?

Overall the one big area where I think Huang has really improved is his ability to find and initiate business opportunities and partnerships.

When he started Genesis 22 Ventures, His venture was not receiving stable cash flow except for the return on the investments. He or his patterns did not know that a venture capital fund can expand its business through partnerships and pitching good projects to other VC firms. This way they can build a revenue stream based on commission without risking their own money.

When I brought this up to him, he learned the rules quickly. He has put in great effort in communicating with other VCs to understand how others operate and create business ideas. The first few times when I had meetings with Huang he could only interpret the general basics of the start-up projects. Therefore, he was not able to provide insightful opinions in decision making. After Huang talked to many teams and spent much time reading industry news, I observed that he was getting better and better at describing business models of different projects in a big picture. Although Huang doesn’t have a strong technology background, he is able to integrate the work of analysts into his knowledge and present a blockchain project in a big picture smoothly.

Through partnerships and advisory services, Huang has helped the venture generate around $40,000 in extra revenue. Genesis 22 has expanded its services to crypto exchange listing consulting, funding advisory and community management for startup projects, etc.

I have seen him learn and grow and I think Huang has progressed massively in his commercial awareness.

If you are a professional referee, would you work with the applicant again post-Masters in Financial Analysis?

Absolutely. Although his fund currently suffers a drop in the quality of deal flow given the bearish situation of the blockchain market, he has made the right decision to make very few investments recently based on the interests of investors. I respect his decision to pursue a master’s in finance degree, and if he wants to resume his Venture Capital firm full-time or work at my VC in the future I would love to work with him again.

Do's & Don'ts - of a Recommendation Letter

Do’s:

Choose the Right Recommender:

- Select someone who knows you well, can speak to your professional skills and achievements, and can provide detailed and specific examples of your work. Current or past supervisors, clients, or mentors who have worked closely with you are ideal choices.

Provide Specific Examples:

- Ensure the recommender includes specific examples of your accomplishments, skills, and experiences. This makes the recommendation more credible and impactful. Detailed anecdotes and quantifiable achievements are particularly effective.

Meet with Your Recommender:

- Schedule a meeting with your recommender to discuss your goals, achievements, and reasons for pursuing an MBA. Provide them with a detailed résumé and a list of your accomplishments to help them write a thorough and personalized letter.

Ensure Timely Submission:

- Set a personal deadline for your recommenders that is well ahead of the actual application deadline. This helps ensure that your letters are submitted on time and reduces last-minute stress.

Highlight Strengths and Areas for Growth:

- Encourage your recommender to provide a balanced view by mentioning your strengths along with areas for growth. Constructive feedback adds credibility and shows your willingness to improve.

Don’ts:

Don’t Write Your Own Recommendation:

- Never write your own letter of recommendation, even if a recommender suggests it. Admissions committees can easily detect self-written letters, which can harm your application.

Don’t Choose Recommenders Based on Title Alone:

- Avoid selecting recommenders solely based on their impressive titles or positions if they do not know you well. A letter from a CEO or politician who has minimal interaction with you is less effective than one from someone who can provide detailed insights into your work and character.

Don’t Use Generic Praise:

- Ensure your recommender avoids using vague, generic praise without backing it up with specific examples. Statements like “She is a great employee” are less impactful than detailed anecdotes that illustrate why you are exceptional.

Don’t Ignore the Application Instructions:

- Make sure your recommenders follow the specific instructions and format required by each business school. Different schools may have varying requirements, and it’s important to adhere to them.

Don’t Overload with Superlatives:

- Encourage your recommender to be honest and avoid excessive use of superlatives. Over-the-top praise without substance can seem insincere. Balanced, realistic assessments that highlight genuine strengths and achievements are more effective.

These do’s and don’ts will help ensure that the letters of recommendation are strong, credible, and supportive of your MBA application.

Free Sample Template - for you to Use

Here’s is a quick template tailored for candidates applying to a Master’s in Finance program:

—

Admissions Committee

[Finance Program Name]

[University Name]

[University Address]

[City, State, ZIP Code]

[Date]

Subject: “Letter of recommendation for [Candidate’s Name]”

Dear Members of the Admissions Committee,

I am pleased to write this letter of recommendation for [Candidate’s Name]. I have had the pleasure of working with [Candidate’s Name] at [Company Name] for [duration], where I serve as [Recommender’s Title]. In my capacity, I have directly supervised [Candidate’s Name] and have gained a thorough understanding of their professional capabilities and character, particularly in the field of finance.

Specific Examples of Performance and Achievements

[Candidate’s Name] has consistently demonstrated exceptional [skills/qualities] in finance. For example, in [specific project/task], [Candidate’s Name] [specific action taken], which resulted in [quantifiable result/outcome]. This achievement is indicative of [Candidate’s Name]’s [particular quality, e.g., analytical skills, financial modeling, risk management].

Another instance of [Candidate’s Name]’s capabilities was during [another specific project/task]. Here, [Candidate’s Name] [specific action taken], leading to [quantifiable result/outcome]. This project highlighted [Candidate’s Name]’s ability to [related skills, e.g., manage financial portfolios, conduct market analysis, handle complex financial challenges].

Constructive Feedback and Areas of Improvement

During our time working together, I provided [Candidate’s Name] with constructive feedback on [specific area for improvement]. In response, [Candidate’s Name] [specific actions taken to improve]. This demonstrated their openness to feedback and commitment to personal and professional growth in the financial sector.

Leadership Skills and Team Inclusiveness

[Candidate’s Name] is known for their inclusiveness and encouragement of others. For example, during [specific instance], [Candidate’s Name] [specific actions taken to include and encourage others]. This behavior fostered a collaborative and supportive work environment and showcased their leadership and interpersonal skills.

Conclusion and Endorsement

In conclusion, I wholeheartedly endorse [Candidate’s Name] for the [Master’s in Finance program] at [University Name]. I am confident that [Candidate’s Name]’s [specific strengths/qualities] will be an asset to your program and that they will thrive in the academically rigorous and collaborative environment of [University Name].

Please feel free to contact me at [Recommender’s Email] or [Recommender’s Phone Number] if you require any further information.

Sincerely,

[Recommender’s Name]

[Recommender’s Title]

[Company Name]