Trinity College Application Essays & Questions 2023-2024

- Why are you interested in the Trinity MIF program?

- What about the program appeals to you and aligns with your academic and career goals?

- The Trinity MIF program prides itself on fostering a collaborative environment. Provide an example of when you successfully collaborated with others to achieve a common goal. What was your role and what did you learn from the experience?

- The Trinity MIF curriculum integrates coursework from multiple disciplines including math, physics, and computer science. How will this interdisciplinary approach help you address complex real-world problems? Provide an example of a complex problem and how your interdisciplinary skills would help develop an innovative solution.

- Describe a time when you overcame an academic challenge or obstacle. How did you approach the situation and what did you learn from it? How will this experience shape your approach to the rigor of the Trinity MIF program?

Trinity College Winning Sample Essays – 1

Why are you interested in the Trinity MIF program? What about the program appeals to you and aligns with your academic and career goals?

My interest in the Trinity MIF program stems from a deep-rooted passion for the financial industry and a relentless pursuit of knowledge and excellence. With over six years of professional experience as an Investment Analyst at Compass Group LLC, one of the largest Latin American hedge funds, I have developed a profound understanding of the intricacies of financial markets and a strong appreciation for the complexities of the investment management industry.

The Trinity MIF program’s rigorous curriculum, which seamlessly integrates advanced financial theory with practical applications and quantitative techniques, aligns perfectly with my aspirations to become a leader in the field of quantitative finance and risk management. The program’s emphasis on cutting-edge technologies, such as machine learning and artificial intelligence, and their applications in finance, resonates deeply with my goal of driving innovation and developing novel approaches to investment decision-making, risk management, and portfolio optimization.

Furthermore, the interdisciplinary nature of the program, with its integration of coursework from mathematics, physics, and computer science, appeals to my intellectual curiosity and my belief in the power of a holistic approach to solving complex real-world problems. This multidisciplinary perspective will undoubtedly broaden my horizons and equip me with the diverse skillset necessary to navigate the increasingly interconnected and rapidly evolving financial landscape.

Moreover, the Trinity MIF program’s reputation for academic excellence, combined with its emphasis on practical applications and real-world case studies, aligns seamlessly with my aspiration to become a Quantitative Portfolio Manager or a Risk Management Specialist within a prominent investment management firm or a global financial institution. The program’s experiential learning opportunities and industry collaborations will provide me with invaluable exposure to real-world challenges, preparing me to hit the ground running and make an immediate impact in my future roles.

Ultimately, the Trinity MIF program’s commitment to fostering a collaborative and intellectually stimulating environment resonates deeply with my personal values and learning style. The opportunity to engage with a diverse cohort of like-minded individuals, exchange ideas, and collaborate on innovative solutions will not only enrich my academic experience but also shape me into a well-rounded and effective leader in the field of quantitative finance.

The Trinity MIF program prides itself on fostering a collaborative environment. Provide an example of when you successfully collaborated with others to achieve a common goal. What was your role and what did you learn from the experience?

Collaboration and effective teamwork have been integral components of my professional journey, and one experience that exemplifies my ability to successfully collaborate with others to achieve a common goal was my involvement in analyzing a complex wind blade producer IPO at Compass Group LLC.

In November 2020, a wind blade producer, operating in an industry with no comparable public companies in Latin America, was set to go public. The lack of a track record and the intersectional drivers of this business, such as global energy demand and grid mix changes, made it a challenging case to analyze, and one that the market approached with trepidation.

As the company fell within my coverage of the Industrial sector, I was assigned to analyze the investment opportunity. However, recognizing my lack of domain knowledge in the energy field, which was a critical factor in evaluating this company, I took the initiative to propose a collaborative approach. I reached out to our energy analyst in Compass Group’s Brazil office and suggested joining forces to build a comprehensive case study and gain a thorough understanding of the main drivers impacting this company’s future performance.

In this collaborative effort, my role was to lead the coordination and facilitate open communication between our respective teams. I ensured that our regular meetings were productive, fostering an environment where both teams could contribute their unique perspectives and expertise. Additionally, I took the responsibility of consolidating our findings, preparing the investment case, and presenting our recommendations to the portfolio managers.

This collaborative approach proved to be highly successful. By leveraging our collective knowledge and diverse backgrounds, we were able to develop a solid investment thesis and effectively communicate our conviction to the portfolio managers. Consequently, the IPO was a resounding success, with the stock generating a 70% return within the first year of trading.

Through this experience, I learned the invaluable lesson of embracing diverse perspectives and leveraging the collective wisdom of a team. I recognized the power of humility and the willingness to seek out expertise beyond one’s own domain, as it can lead to more comprehensive and innovative solutions. Additionally, I developed a deeper appreciation for the importance of clear communication, active listening, and fostering an inclusive environment where all team members feel valued and empowered to contribute their unique insights.

As I embark on the Trinity MIF program, this experience has reinforced my belief in the power of collaboration and my commitment to fostering an environment that encourages diverse perspectives and open dialogue. I am eager to engage with my peers, learn from their unique backgrounds and experiences, and contribute to a vibrant and intellectually stimulating community.

The Trinity MIF curriculum integrates coursework from multiple disciplines including math, physics, and computer science. How will this interdisciplinary approach help you address complex real-world problems? Provide an example of a complex problem and how your interdisciplinary skills would help develop an innovative solution.

The interdisciplinary approach of the Trinity MIF curriculum, which integrates coursework from mathematics, physics, and computer science, is particularly well-suited to address the complex and multifaceted challenges that characterize the modern financial industry. By combining theoretical foundations from diverse disciplines with practical applications and real-world case studies, this program will equip me with a holistic toolkit to tackle intricate problems and develop innovative solutions.

One of the most complex problems I have encountered in my professional experience was the analysis of a wind blade producer’s IPO, where the lack of industry benchmarks and the intersectional drivers, such as global energy demand and grid mix changes, made it a challenging case to evaluate. This situation highlighted the limitations of traditional financial analysis methods and the need for a more comprehensive and interdisciplinary approach.

In this context, the integration of mathematical and computational skills from the Trinity MIF curriculum would have been invaluable. Advanced quantitative techniques, such as stochastic modeling and simulation, could have been employed to develop robust forecasting models that incorporate the uncertainty and volatility inherent in the energy sector. Moreover, machine learning algorithms and natural language processing could have been leveraged to analyze vast amounts of data, including industry reports, news articles, and social media sentiment, to gain deeper insights into market trends and consumer behavior.

Furthermore, the program’s emphasis on physics would have provided me with a deeper understanding of the underlying principles that govern energy production and distribution systems. This knowledge, combined with the quantitative and computational skills, could have facilitated the development of more accurate valuation models and risk management strategies tailored to the unique challenges of the renewable energy industry.

By integrating these interdisciplinary skills, I could have developed a more holistic and innovative solution to this complex problem. Instead of relying solely on traditional financial analysis methods, I could have leveraged advanced quantitative techniques, computational tools, and domain-specific knowledge from physics to create a comprehensive investment thesis that accounts for the multifaceted drivers impacting the wind blade producer’s performance

Moreover, the Trinity MIF program’s focus on collaboration and teamwork would have allowed me to assemble a diverse team of experts, each contributing their unique disciplinary perspective and expertise. This collaborative approach would have fostered a cross-pollination of ideas and enabled us to tackle the problem from multiple angles, ultimately leading to a more robust and innovative solution.

In summary, the interdisciplinary nature of the Trinity MIF curriculum will equip me with the necessary tools and mindset to address complex real-world problems in the financial industry. By combining advanced quantitative techniques, computational methods, domain-specific knowledge, and a collaborative approach, I will be better prepared to navigate the challenges of an increasingly interconnected and rapidly evolving financial landscape.

Describe a time when you overcame an academic challenge or obstacle. How did you approach the situation and what did you learn from it? How will this experience shape your approach to the rigor of the Trinity MIF program?

Throughout my academic journey, I have encountered numerous challenges and obstacles that have tested my resilience, perseverance, and ability to adapt. One particular experience that stands out is the period when my parents went through a difficult divorce during my final year of high school. This personal upheaval coincided with a pivotal moment in my academic life, as I had been accepted to study Business Administration at one of the most prestigious universities in Buenos Aires.

However, the financial strain resulting from my parents’ divorce forced me to make a difficult choice. With my father no longer providing financial support and my brother already pursuing his studies in the capital, I became the sole emotional and economic support for my mother. Consequently, I had to decline the offer from the university in Buenos Aires and instead explore alternative paths closer to home.

Undeterred by this setback, I approached the situation with a growth mindset and a determination to turn adversity into an opportunity for personal and professional growth. I took on multiple part-time jobs and freelance gigs within my local community, working tirelessly to support my mother and contribute to our financial stability. This experience taught me invaluable lessons in time management, prioritization, and the importance of a strong support system.

Through this challenging period, I developed a deep sense of resilience and perseverance, qualities that have become integral to my approach to overcoming obstacles. Additionally, the support and guidance I received from my local community instilled in me a profound appreciation for the power of collaboration and the importance of fostering strong networks.

This experience also taught me the value of adaptability and the willingness to embrace alternative paths when faced with unforeseen circumstances. Instead of allowing the setback to derail my aspirations, I refocused my efforts and pursued my undergraduate studies at the Universidad Católica de Salta, where I graduated as the valedictorian, exemplifying my commitment to academic excellence despite the challenges I faced.

As I prepare to embark on the rigorous Trinity MIF program, this formative experience will shape my approach in several ways. First, it has reinforced my resilience and determination to overcome any obstacles that may arise, approaching them not as insurmountable barriers but as opportunities for growth and personal development.

Second, I will carry with me the invaluable lessons of time management, prioritization, and the importance of striking a healthy balance between academic demands and personal responsibilities. The ability to effectively juggle multiple commitments will be crucial in navigating the intensive coursework and extracurricular opportunities offered by the Trinity MIF program.

Furthermore, my appreciation for collaboration and the power of diverse perspectives will foster a more enriching and fruitful learning experience. I will actively seek out opportunities to engage with my peers, exchange ideas, and leverage our collective strengths to tackle complex problems and develop innovative solutions.

Lastly, my experience has instilled in me a mindset of adaptability and openness to alternative paths. I will approach the Trinity MIF program with a growth mindset, embracing new challenges and remaining receptive to unexpected opportunities that may arise, ultimately shaping my academic and professional journey in ways I cannot yet foresee

In essence, the lessons learned from overcoming this significant academic challenge have fortified my resilience, time management skills, appreciation for collaboration, and adaptability – qualities that will undoubtedly serve me well as I navigate the rigors and intellectual demands of the Trinity MIF program. By drawing upon these experiences, I am confident in my ability to not only succeed academically but also to make meaningful contributions to the vibrant and intellectually stimulating community at Trinity College.

Quick Essay Review

Worried if your Essay is Good enough or Not?

Need a last-minute review?

Submit your essays below & get in-depth feedback within 48 Hours.

Trinity College Winning Sample Essays – 2

Why are you interested in the Trinity MIF program? What about the program appeals to you and aligns with your academic and career goals?

My interest in the Trinity MIF program stems from its rigorous curriculum, distinguished faculty, and the emphasis on fostering a collaborative environment. These elements align seamlessly with my academic background and career aspirations, making Trinity College Dublin an ideal choice for my further education.

Firstly, the comprehensive curriculum of the MIF program at Trinity covers essential aspects of finance, including corporate finance, financial markets, and econometrics, which are critical for developing a robust understanding of financial economics. Having completed my CFA Level 3, I have a solid foundation in financial analysis and investment management. However, I believe that the in-depth knowledge provided by the MIF program will equip me with advanced financial theories and practical skills necessary for my career in Real Estate Private Equity (REPE). Courses such as Real Estate Finance and Financial Derivatives particularly appeal to me as they will provide specialized knowledge directly applicable to my field.

The distinguished faculty at Trinity College Dublin is another significant factor in my decision. Learning from professors who are leaders in their fields will not only enhance my understanding of complex financial concepts but also expose me to cutting-edge research and industry practices. The opportunity to engage with these experts and gain insights from their extensive experience is invaluable for my professional growth.

Additionally, the collaborative environment at Trinity College Dublin is particularly appealing. I have always thrived in settings that encourage teamwork and knowledge sharing. I believe that learning alongside a diverse group of peers, each bringing unique perspectives and experiences, will enrich my educational experience and broaden my understanding of global financial markets. This collaborative spirit is essential in finance, where complex problems often require innovative solutions developed through teamwork.

In the next five years, my career goal is to transition into a role at a leading Real Estate Private Equity firm such as Blackstone or Brookfield. The MIF program at Trinity will provide me with the advanced financial knowledge and analytical skills required to excel in this field. Moreover, the program’s focus on practical applications and real-world problem-solving will prepare me to navigate the complexities of the financial industry effectively.

Long-term, I aim to leverage my experience and expertise to establish my own Real Estate Private Equity firm in India. The entrepreneurial spirit fostered at Trinity College Dublin, along with the support of its extensive alumni network, will be instrumental in achieving this goal. The global reputation of Trinity and its strong connections with the finance industry will open doors to valuable networking opportunities and partnerships.

In conclusion, the Trinity MIF program offers the perfect blend of rigorous academics, distinguished faculty, and a collaborative learning environment. This combination aligns perfectly with my academic background and career aspirations, making it the ideal program to help me achieve my goals. I am confident that the knowledge, skills, and network I will gain from the MIF program at Trinity College Dublin will be pivotal in my journey towards a successful career in Real Estate Private Equity and beyond.

The Trinity MIF program prides itself on fostering a collaborative environment. Provide an example of when you successfully collaborated with others to achieve a common goal. What was your role and what did you learn from the experience?

One of the most significant experiences of collaboration in my professional life occurred during my tenure as Social Media Marketing Lead at POPxo, India’s largest digital community for women. The project involved strategizing and executing a comprehensive social media campaign for Amazon India Fashion Week, a major event in the fashion industry. This was a high-stakes project with ambitious targets for growth, engagement, and reach.

As the Social Media Marketing Lead, my role was to coordinate the efforts of our team, which consisted of four content creators, a graphic designer, and a data analyst. Our common goal was to achieve unprecedented levels of engagement and reach for the event. The challenge was to create a cohesive and compelling narrative that would resonate across multiple social media platforms, while also meeting the key performance indicators (KPIs) set by our client, Amazon India.

The first step in our collaboration was to establish clear communication channels and define our roles and responsibilities. I organized brainstorming sessions where each team member contributed ideas and strategies. This inclusive approach not only fostered a sense of ownership and accountability but also ensured that we leveraged the diverse skills and perspectives within our team.

One of the key initiatives was to create a series of behind-the-scenes content that showcased the preparation and excitement leading up to the fashion week. This required close coordination between the content creators, who captured the footage, and the graphic designer, who edited and enhanced the visuals. I oversaw the content production process, ensuring that our narrative remained consistent and aligned with our brand message.

Another critical aspect of the project was data analysis. Our data analyst tracked the performance of our posts in real-time, providing insights into what was working and what needed adjustment. This iterative process allowed us to refine our strategy dynamically. I facilitated regular check-ins to review our progress and make data-driven decisions, ensuring that we stayed on track to meet our KPIs.

Through this collaborative effort, we achieved record high organic growth rates of 400-600% across our social media channels. The campaign’s success was a testament to the power of teamwork and the effective coordination of diverse talents towards a common goal.

This experience taught me several valuable lessons about collaboration. Firstly, it reinforced the importance of clear communication and defined roles within a team. When everyone understands their responsibilities and has a platform to share their ideas, the team operates more efficiently and creatively. Secondly, it highlighted the value of leveraging diverse perspectives. Our team’s varied backgrounds and skills were crucial in creating a multi-faceted and engaging campaign. Lastly, it emphasized the importance of adaptability and continuous improvement. By regularly reviewing our performance and making data-driven adjustments, we were able to optimize our strategy and achieve our goals.

In conclusion, the collaborative environment at Trinity MIF, which fosters teamwork and knowledge sharing, is something I am particularly excited about. My experience at POPxo has prepared me to contribute effectively to such an environment, where I can collaborate with peers to tackle complex financial challenges and achieve common goals.

The Trinity MIF curriculum integrates coursework from multiple disciplines including math, physics, and computer science. How will this interdisciplinary approach help you address complex real-world problems? Provide an example of a complex problem and how your interdisciplinary skills would help develop an innovative solution.

The interdisciplinary approach of the Trinity MIF program, which integrates coursework from math, physics, and computer science, is particularly appealing to me. In today’s rapidly evolving financial landscape, the ability to draw from multiple disciplines is crucial for developing innovative solutions to complex problems. This approach aligns well with my background and the skills I have developed throughout my career.

One example of a complex problem I faced was during my tenure at Finstop, where we aimed to develop a financial analytical platform for Indian investors. The challenge was to create a proprietary ranking system for Indian mutual funds that could provide reliable and actionable insights to investors. This required not only a deep understanding of financial principles but also the ability to analyze vast amounts of data and develop sophisticated algorithms.

My interdisciplinary skills played a pivotal role in addressing this challenge. My foundation in financial analysis, strengthened by my CFA Level 3, provided the necessary knowledge to evaluate mutual funds and understand market trends. However, to develop a robust ranking system, I needed to integrate principles from other disciplines, particularly math and computer science.

I collaborated closely with a team of data scientists and software engineers to design and implement the ranking system. The first step was to gather and preprocess a large dataset of mutual fund performance metrics. This required mathematical skills to ensure that the data was accurately normalized and standardized. I used statistical techniques to identify key performance indicators and develop a model that could predict future fund performance based on historical data.

Next, we utilized principles from computer science to develop the algorithm for the ranking system. This involved programming in Python and using machine learning techniques to refine the model. My understanding of computer science allowed me to communicate effectively with the software engineers and contribute to the development of the algorithm. We employed iterative testing and validation to ensure that the system was reliable and provided accurate recommendations.

One specific challenge we faced was accounting for market volatility and economic shifts, which could significantly impact fund performance. Here, my knowledge of physics, particularly concepts related to dynamic systems and statistical mechanics, proved useful. I applied these principles to develop a more robust model that could adapt to changing market conditions and provide more accurate predictions.

The interdisciplinary approach not only helped us develop a successful ranking system but also enabled us to offer a unique value proposition to our users. The platform was well-received, and we saw a significant increase in user engagement and satisfaction.

This experience demonstrated the importance of integrating knowledge from multiple disciplines to address complex problems. The interdisciplinary curriculum of the Trinity MIF program will further enhance my ability to tackle such challenges. By deepening my understanding of math, physics, and computer science, I will be better equipped to develop innovative solutions in the financial industry.

In conclusion, the interdisciplinary approach of the Trinity MIF program will provide me with a comprehensive skill set that is essential for addressing complex real-world problems. My experience at Finstop has shown me the value of integrating knowledge from multiple disciplines, and I am excited to further develop these skills at Trinity College Dublin.

Describe a time when you overcame an academic challenge or obstacle. How did you approach the situation and what did you learn from it? How will this experience shape your approach to the rigor of the Trinity MIF program?

One of the most significant academic challenges I faced occurred during my undergraduate studies in Business Economics at the University of Exeter. In my final year, I was tasked with a comprehensive research project that required a deep understanding of econometric models and advanced statistical techniques. The project was particularly challenging because it involved analyzing a large dataset on the economic impact of policy changes, a topic I had limited experience with at the time.

The initial stages of the project were overwhelming. The complexity of the econometric models and the volume of data I needed to process were daunting. My first attempts at running the analyses were met with numerous errors and inconclusive results. It became clear that my existing knowledge was insufficient to complete the project successfully.

To overcome this obstacle, I adopted a structured and multi-faceted approach. Firstly, I sought guidance from my professors and peers. I attended additional office hours and study groups, where I could ask questions and gain insights from those more experienced in econometrics. This collaborative effort provided me with a better understanding of the theoretical underpinnings of the models I was working with.

Secondly, I dedicated significant time to self-study. I utilized online resources, academic journals, and textbooks to deepen my understanding of advanced econometric techniques. I also enrolled in an online course focused on econometrics, which provided me with practical examples and exercises to reinforce my learning. This self-directed learning helped me build the necessary skills to tackle the project more effectively.

Thirdly, I approached the problem systematically. I broke down the project into smaller, manageable tasks and set specific milestones to track my progress. This helped me stay organized and focused, ensuring that I did not become overwhelmed by the complexity of the work. I also used project management software to keep track of my tasks and deadlines, which improved my efficiency and time management.

After several weeks of intensive study and consistent effort, I was able to complete the project successfully. The final analysis provided valuable insights into the economic impact of policy changes, and my work was well-received by my professors. This experience taught me the importance of perseverance, continuous learning, and the value of seeking help when faced with challenges.

This academic challenge also highlighted the importance of a systematic approach to problem-solving, which I believe will be crucial in tackling the rigor of the Trinity MIF program. The interdisciplinary nature of the program will undoubtedly present complex problems that require a deep understanding of multiple disciplines. My experience has equipped me with the skills to approach these challenges methodically and effectively.

In conclusion, overcoming the academic challenge during my undergraduate studies has prepared me well for the demands of the Trinity MIF program. It has taught me the importance of perseverance, continuous learning, and a systematic approach to problem-solving. I am confident that these lessons will help me succeed in the rigorous and interdisciplinary environment at Trinity College Dublin.

Trinity College Recommendation Letter – Key Questions

Two academic referees

MiF Recommendation Letters

(Free Samples & successful Examples)

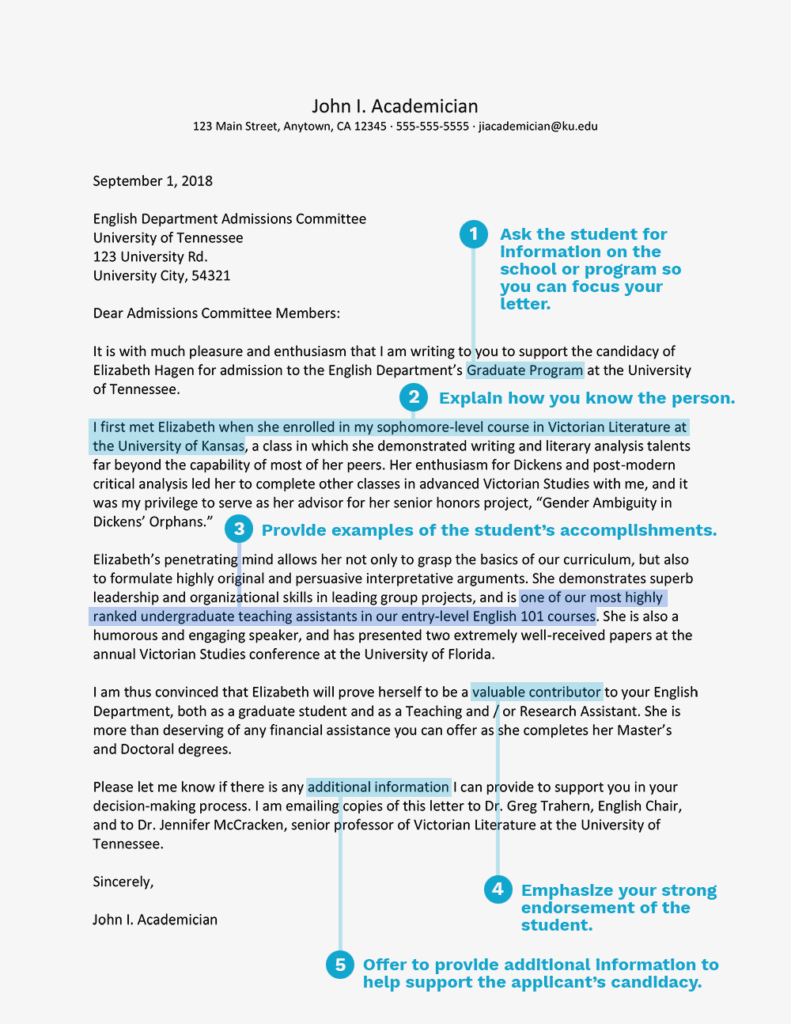

Professor - Recommendation letter Sample 1

Here is a quick PDF of a sample recommendation our client submitted for a successful admit.

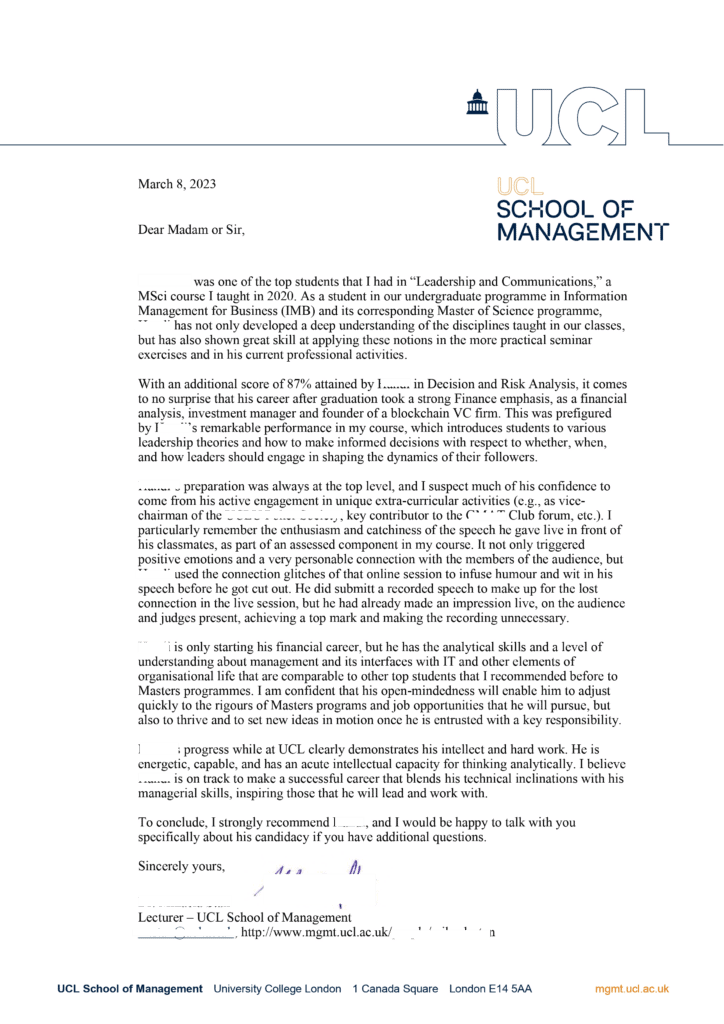

Professor - Recommendation letter Sample 2

To,

Admissions Committee

HEC Paris – Masters in Finance Program

Date: 08-09-2023

Subject: “Recommendation letter for Akhil’s application to MIF program at HEC Paris”

Dear Admissions Committee,

I have known Akhil for over 2 years now. He was a student in my Entrepreneurship course as part of his Minor in Entrepreneurship and Management. As a student in my class, Akhil showed great skill at applying these notions in the more practical in-class quizzes, his final group business pitch at the end of the course, and his professional activities at UBS. Akhil’s also had a remarkable performance in my course, in which Akhil got the highest grade possible of A+.

In terms of his potential,

Akhil stood out to me in the final project that I gave as part of the course evaluation. As a major assessment, I give a project assignment for students to work in groups and pitch a good, self-sustaining business idea.

Akhil took the initiative and created a multicultural and diverse team with students not only from different countries but also students from different majors and successfully delivered a group business pitch for a student-run laundry and cleaning business. The idea picked by his team was unique, and he actively sought my advice and mentorship to make the team and the project successful.

Another noteworthy facet is the analytical research done by Akhil before and after seeking my advice; he actively made an effort to learn about diverse topics that he had not been exposed to before and was successfully able to learn about the different aspects of entrepreneurship, such as management and finance. Demonstrating his goal and detail-oriented ability. Rhe idea, the data oriented research, and the financial analysis were really impressive (synthesized and executed on assigned taks). Also, the real-world considerations regarding the execution of the pitch, as well as the cohesive delivery from a team collaboration perspective, were good.

I liked the project, and I asked Akhil if I could include the pitch and presentation as teaching material for my course as well as offering a Research Assistant position to Akhil in the next summer, which he was unable to take due to him having graduated

With his analytical skills and his collaborative approach, it came to me as no surprise that he was able to successfully chase his goal and transition into finance directly from his undergrad in engineering, landing a role in finance with UBS in their Investment Banking Operations in Hong Kong.

In terms of his potential areas of Improvement

I think Akhil’s analytical nature and detail-orientedness sometimes leads to him getting too caught up in details and spending excess time on the intricate details, leading to improper time management.

In the group project, Akhil struggled with time management and was a week behind schedule for his group due to him giving equal attention to all the details of the presentation, losing track of the bigger picture of the project. With my guidance, he was able to get back on speed and submitted the project by the submission deadline. But I believe that Akhil needs to work on gaining a view of the overall project that he is working for better time management.

Overall Recommendation

Akhil is only starting his financial career, but he has the analytical skills and a level of understanding about management, teamwork and other elements of organizational life that are comparable to other top students that I recommended before to Masters programs.

Akhil’s progress at CityU and at UBS clearly demonstrates his intellect and hard work. He is capable and has an acute intellectual capacity for thinking analytically. I believe Akhil is on track to make a successful career that blends his quantitative inclinations with his qualititaive skills, inspiring those that he will lead and work with.

To conclude, I strongly recommend Akhil, and I would be happy to talk with you specifically about his candidacy if you have additional questions.

Regards

Professor XXXXXX

Head of the Department of Entrepreneurship and Management

XXXX University

Internship Manager - Recommendation Letter Sample 1

How long and in what capacity have you known the candidate?

I have known Pranav for roughly one and a half years. I was his mentor during his internship with UBS. Although he completed his internship and has moved on, we still continue to keep in touch to exchange different business ideas.

What do you think about the candidate’s professional performance and potential (including any room for improvement)?

When Pranav started his internship with UBS, he was one of the most proactive interns. Since he didn’t have a finance background, he showed keen interest in learning and came up the curve very quickly.

The team assigned him Automation and Efficiency-related projects, and while working in the automation team he managed to stand out from other interns by providing solutions that were slightly outside of the box and impressed everyone on the team.

For instance, he met with various team leads to understand their automation requirements and one team lead expressed her frustration with the manual risk report that used to take 10-12 hours every quarter. After the meeting, Pranav took the proactive step of helping automate this report for the team. The specific process automation that he implemented was for risk reports for the risk team. The team had a manual time consuming process in which they had to refer to multiple Excel sheets to create their quarterly risk report. Pranav understood and mapped the entire process before using an automation tool to automate it. This led to a time reduction of 90 percent in the compilation of the report. The automation process he designed was ingenious; no one had thought of using it before, and that is why I think everyone was impressed with his out-of-the-box thinking.

Apart from that, another one of his biggest strengths is his willingness to take initiative.

To highlight another instance, he noticed the dashboards in Operations and wider UBS were on Tableau, he took the initiative to compare Tableau and PowerBi and pitched shifting the employee statistics dashboard to PowerBi. The management team agreed and Pranav successfully created an Employee demographic dashboard on PowerBi. This led to cost savings for the department as UBS was already paying for PowerBi. He also took even more initiative, helping others in his team and UBS get certified on PowerBi and documented his knowledge for everyone before he left his internship.

On the flip side, when it comes to areas of improvement, I would also say this proactiveness and eagerness sometimes led to difficult situations. Like other fresh hires, he was also trying to prove himself in the initial months of his tenure with the team. However, this often meant that he would try to manage and solve things on his own instead of seeking help. This led to delays and situations becoming critical.

Pranav was tasked with getting certified on Automation Anywhere, another automation tool used by the team. He was unable to crack the certification according to the timeline assigned to him and was delayed by a month in getting certified. He tried to manage and solve the situation but was unable to do so without help from his team, this delay led to an increased workload for the rest of the team and longer hours as work had been earmarked for Pranav to do as soon as he would be finished with the certification.

Overall, I would say that Pranav has great potential; he is not afraid to take the initiative and present his ideas.

Regards

XXXXXX

Manager – UBS, Hong Kong Offices

Internship Manager - Recommendation Letter Sample 2

How do you know the applicant? How long have you known them for?

I have known Huang for almost 2 years now.

I came to know Huang when he was working at Chainfir Capital. I was an investor of the fund at Chainfir Capital. Huang worked as an investment manager at Chainfir and we had meetings together from time to time.

Later when Huang and his colleagues decided to start their own Venture Capital fund (Genesis 22) focused on crypto industry, I joined their venture both as an investor and an advisor of their VC Fund.

What would you say are the applicant’s key strengths and talents?

After working with Huang, I think one of his key talents is that he is very detail oriented and loves to perform extensive due diligence.

For instance, Genesis 22 was close to making an investment decision on a project called Glitter Finance last year. At the time, it was a rather popular project among VCs and had already received several investments. The analyst in our team provided positive comments on its technology and future potential.

Huang was responsible for speaking with the project team and conducting due diligence. He was able to approach the situation with a sceptical mind and later identified several risks of the project by paying attention to each detail. He made an analysis of the profile of each team member of the project and determined that the technical background of the team was not strong enough to develop the promising highly technical project they claimed. Also, he mentioned that while observing all the interaction between the founder of the project and individual investors in the community group, he noticed that the founder often gets angry easily when facing tough questions.

He raised these concerns during the investment decision meeting, and at the end of the meeting, we decided not to invest. A few months later – the project went bust because the value of the project was way inflated and every institutional investor suffered a loss. I am glad that Huang was able to pay close attention to such details and has always worked with great attention to achieve better performance.

Another key talent of Huang is his multi-tasking skills. I am really impressed by his performance in dealing with a variety of projects simultaneously. When he works as an investment manager in the team, he needs to handle the communication and investigation with 5-8 projects at the same time. He has never left others waiting for his work, and we can always set up the evaluation meeting in the anticipated time frame. He is also able to deal with the pressure when there are extra projects which need his attention.

What would you say are the applicant’s key weaknesses or areas for improvement?

As the founder of a venture capital firm, Huang has built a team and became a leader at such a young age. But I think there is still room for improvement in his management skills, especially in delegating workload.

As Huang prefers to participate in every stage of the investment decision of a certain project, it limits the overall number of projects he can oversee. For example, he spent much time on initial screening and understanding complex technology concepts of different projects. In my opinion, he could delegate this work and trust his colleagues to complete these tasks as our analysts with technology backgrounds are capable of determining the technology feasibility so that he can invest most of his time in reviewing the big picture.

Second thing I have asked him to improve upon is that he can sometimes be over-optimistic and confident when things are going well. From my perspective, it is crucial to keep a cool mind when dealing with different market situations. When he started Genesis 22, several investments that we made looked promising. Consequently, he was on the aggressive side to allocate a higher proportion of the fund to such projects. However, when there was a change in the market trend and crypto industry started crashing, some investments did not perform as well as we expected. The fund suffered extra losses because of the higher allocation made to these investments.

Huang realized his mistake afterwards and became more cautious in making an allocation to investments to improve the diversification of the portfolio. I hope he has learned his lesson and does not repeat the same mistake again.

In which areas of development has the applicant progressed most in the time you’ve known them?

Overall the one big area where I think Huang has really improved is his ability to find and initiate business opportunities and partnerships.

When he started Genesis 22 Ventures, His venture was not receiving stable cash flow except for the return on the investments. He or his patterns did not know that a venture capital fund can expand its business through partnerships and pitching good projects to other VC firms. This way they can build a revenue stream based on commission without risking their own money.

When I brought this up to him, he learned the rules quickly. He has put in great effort in communicating with other VCs to understand how others operate and create business ideas. The first few times when I had meetings with Huang he could only interpret the general basics of the start-up projects. Therefore, he was not able to provide insightful opinions in decision making. After Huang talked to many teams and spent much time reading industry news, I observed that he was getting better and better at describing business models of different projects in a big picture. Although Huang doesn’t have a strong technology background, he is able to integrate the work of analysts into his knowledge and present a blockchain project in a big picture smoothly.

Through partnerships and advisory services, Huang has helped the venture generate around $40,000 in extra revenue. Genesis 22 has expanded its services to crypto exchange listing consulting, funding advisory and community management for startup projects, etc.

I have seen him learn and grow and I think Huang has progressed massively in his commercial awareness.

If you are a professional referee, would you work with the applicant again post-Masters in Financial Analysis?

Absolutely. Although his fund currently suffers a drop in the quality of deal flow given the bearish situation of the blockchain market, he has made the right decision to make very few investments recently based on the interests of investors. I respect his decision to pursue a master’s in finance degree, and if he wants to resume his Venture Capital firm full-time or work at my VC in the future I would love to work with him again.

Do's & Don'ts - of a Recommendation Letter

Do’s:

Choose the Right Recommender:

- Select someone who knows you well, can speak to your professional skills and achievements, and can provide detailed and specific examples of your work. Current or past supervisors, clients, or mentors who have worked closely with you are ideal choices.

Provide Specific Examples:

- Ensure the recommender includes specific examples of your accomplishments, skills, and experiences. This makes the recommendation more credible and impactful. Detailed anecdotes and quantifiable achievements are particularly effective.

Meet with Your Recommender:

- Schedule a meeting with your recommender to discuss your goals, achievements, and reasons for pursuing an MBA. Provide them with a detailed résumé and a list of your accomplishments to help them write a thorough and personalized letter.

Ensure Timely Submission:

- Set a personal deadline for your recommenders that is well ahead of the actual application deadline. This helps ensure that your letters are submitted on time and reduces last-minute stress.

Highlight Strengths and Areas for Growth:

- Encourage your recommender to provide a balanced view by mentioning your strengths along with areas for growth. Constructive feedback adds credibility and shows your willingness to improve.

Don’ts:

Don’t Write Your Own Recommendation:

- Never write your own letter of recommendation, even if a recommender suggests it. Admissions committees can easily detect self-written letters, which can harm your application.

Don’t Choose Recommenders Based on Title Alone:

- Avoid selecting recommenders solely based on their impressive titles or positions if they do not know you well. A letter from a CEO or politician who has minimal interaction with you is less effective than one from someone who can provide detailed insights into your work and character.

Don’t Use Generic Praise:

- Ensure your recommender avoids using vague, generic praise without backing it up with specific examples. Statements like “She is a great employee” are less impactful than detailed anecdotes that illustrate why you are exceptional.

Don’t Ignore the Application Instructions:

- Make sure your recommenders follow the specific instructions and format required by each business school. Different schools may have varying requirements, and it’s important to adhere to them.

Don’t Overload with Superlatives:

- Encourage your recommender to be honest and avoid excessive use of superlatives. Over-the-top praise without substance can seem insincere. Balanced, realistic assessments that highlight genuine strengths and achievements are more effective.

These do’s and don’ts will help ensure that the letters of recommendation are strong, credible, and supportive of your MBA application.

Free Sample Template - for you to Use

Here’s is a quick template tailored for candidates applying to a Master’s in Finance program:

—

Admissions Committee

[Finance Program Name]

[University Name]

[University Address]

[City, State, ZIP Code]

[Date]

Subject: “Letter of recommendation for [Candidate’s Name]”

Dear Members of the Admissions Committee,

I am pleased to write this letter of recommendation for [Candidate’s Name]. I have had the pleasure of working with [Candidate’s Name] at [Company Name] for [duration], where I serve as [Recommender’s Title]. In my capacity, I have directly supervised [Candidate’s Name] and have gained a thorough understanding of their professional capabilities and character, particularly in the field of finance.

Specific Examples of Performance and Achievements

[Candidate’s Name] has consistently demonstrated exceptional [skills/qualities] in finance. For example, in [specific project/task], [Candidate’s Name] [specific action taken], which resulted in [quantifiable result/outcome]. This achievement is indicative of [Candidate’s Name]’s [particular quality, e.g., analytical skills, financial modeling, risk management].

Another instance of [Candidate’s Name]’s capabilities was during [another specific project/task]. Here, [Candidate’s Name] [specific action taken], leading to [quantifiable result/outcome]. This project highlighted [Candidate’s Name]’s ability to [related skills, e.g., manage financial portfolios, conduct market analysis, handle complex financial challenges].

Constructive Feedback and Areas of Improvement

During our time working together, I provided [Candidate’s Name] with constructive feedback on [specific area for improvement]. In response, [Candidate’s Name] [specific actions taken to improve]. This demonstrated their openness to feedback and commitment to personal and professional growth in the financial sector.

Leadership Skills and Team Inclusiveness

[Candidate’s Name] is known for their inclusiveness and encouragement of others. For example, during [specific instance], [Candidate’s Name] [specific actions taken to include and encourage others]. This behavior fostered a collaborative and supportive work environment and showcased their leadership and interpersonal skills.

Conclusion and Endorsement

In conclusion, I wholeheartedly endorse [Candidate’s Name] for the [Master’s in Finance program] at [University Name]. I am confident that [Candidate’s Name]’s [specific strengths/qualities] will be an asset to your program and that they will thrive in the academically rigorous and collaborative environment of [University Name].

Please feel free to contact me at [Recommender’s Email] or [Recommender’s Phone Number] if you require any further information.

Sincerely,

[Recommender’s Name]

[Recommender’s Title]

[Company Name]