MIT Sloan Application Essays & Questions 2023-2024

Question 1: Please discuss your past academic and professional experiences and accomplishments that will help you succeed in the Master of Finance program. Include achievements in finance, math, statistics, and computer sciences, as applicable.

Question 2: Tell us about your short-term and long-term professional goals. How will our MFin degree help you achieve these goals?

Question 3: What personal qualities will enable you to contribute to the advancement of our mission?

MIT Sloan Winning Sample Essays – 1

Question 1: Please discuss your past academic and professional experiences and accomplishments that will help you succeed in the Master of Finance program. Include achievements in finance, math, statistics, and computer sciences, as applicable.

My academic and professional journey has been driven by a deep passion for finance and a commitment to continuous learning and growth. Throughout my experiences, I have consistently demonstrated a strong quantitative aptitude, analytical mindset, and proficiency in leveraging technology to drive financial success.

Academically, my Bachelor’s degree in Business Administration from the Universidad Católica de Salta laid a solid foundation in financial principles, accounting, and economics. During my coursework, I excelled in quantitative subjects, consistently ranking among the top students in mathematics and statistics. This strong analytical base prepared me for the rigorous Master’s program in Finance at the prestigious Universidad del Cema in Buenos Aires, where I graduated in the top 10% of my class.

In the professional arena, I have accumulated over six years of experience as an Investment Analyst at Compass Group LLC, one of the largest Latin American hedge funds with over $40 billion in assets under management. In this role, I have honed my skills in financial modeling, quantitative analysis, and research, consistently providing data-driven recommendations for equity and credit positions across various strategies.

One of my notable achievements was leading the automation process at Compass Group, where I created several tools for equity screening, performance reporting, and data analysis. These tools streamlined processes and enhanced decision-making capabilities, contributing to the firm’s overall success. Additionally, I played a crucial role in developing marketing materials for our main funds, showcasing my ability to effectively communicate complex financial information to diverse audiences.

Beyond my professional responsibilities, I am currently a Level III candidate in the CFA (Chartered Financial Analyst) program, reflecting my commitment to continuous learning and staying abreast of the latest trends and best practices in the finance industry.

In summary, my academic excellence, professional achievements in the investment management sector, proficiency in quantitative analysis, and dedication to ongoing professional development have equipped me with the necessary skills and mindset to thrive in the Master of Finance program at MIT Sloan.

Question 2: Tell us about your short-term and long-term professional goals. How will our MFin degree help you achieve these goals?

In the short term, my goal is to transition from my current role as an Investment Analyst to a Portfolio Manager position, where I can take on greater responsibility and leverage my analytical skills to make strategic investment decisions. Specifically, I aspire to manage a Latin America-focused Environmental, Social, and Governance (ESG) fund, aligning my professional aspirations with my personal values of promoting sustainable and responsible investing practices.

In the long run, I envision myself as a leader in the investment management industry, contributing to the development and adoption of innovative investment strategies that generate superior returns while positively impacting society and the environment. I aim to establish myself as a thought leader in the field of ESG investing, leveraging my expertise to educate and influence industry peers, policymakers, and the broader investment community.

The Master of Finance program at MIT Sloan is uniquely positioned to support my goals and provide me with the necessary knowledge and skills to achieve them. The program’s rigorous curriculum, which combines cutting-edge financial theory with practical applications, will deepen my understanding of advanced financial concepts, quantitative techniques, and risk management strategies, enabling me to make more informed and data-driven investment decisions.

Furthermore, the program’s emphasis on sustainability and responsible investing aligns perfectly with my long-term aspirations. Courses such as “Sustainable Finance and Impact Investing” and “ESG Investing and Climate

Finance will equip me with the specialized knowledge and tools to navigate the rapidly evolving landscape of ESG investing, positioning me as a leader in this field.

Beyond the academic curriculum, MIT Sloan’s diverse and collaborative community will provide me with invaluable networking opportunities and exposure to diverse perspectives. Engaging with like-minded individuals through student organizations like the Impact Investing Initiative and the Finance Club will broaden my horizons and foster meaningful connections that can lead to future collaborations and career advancement.

Ultimately, the MFin degree from MIT Sloan will not only strengthen my technical and analytical skills but also cultivate my leadership abilities, strategic thinking, and commitment to responsible finance, preparing me to achieve my short-term and long-term professional goals while contributing to the broader mission of promoting sustainable and ethical business practices.

Question 3: What personal qualities will enable you to contribute to the advancement of our mission?

Throughout my personal and professional journey, I have developed a set of qualities that will enable me to contribute meaningfully to the advancement of MIT Sloan’s mission of fostering principled, innovative leaders who improve the world.

First and foremost, I possess a deep-rooted commitment to ethical and responsible decision-making. My involvement with the non-profit organization “Un Techo para mi País” (A Roof for My Country), where I volunteered for two years to build houses for underprivileged families in my community, instilled in me a strong sense of empathy and a desire to create positive social impact. This experience has shaped my perspective on the importance of considering the broader implications of our actions and making decisions that not only drive financial success but also contribute to the greater good of society.

Additionally, I have cultivated a spirit of resilience and determination, qualities that have been forged through overcoming personal challenges. When faced with my parents’ divorce and financial hardships during my formative years, I chose to decline an opportunity to study at a prestigious university in Buenos Aires and instead remained in my hometown to provide emotional and economic support to my mother. This trying period taught me the value of perseverance, adaptability, and the importance of prioritizing family and community.

Another quality that sets me apart is my ability to think critically and approach problems from multiple angles. As an Investment Analyst at Compass Group, I have consistently demonstrated innovative thinking by developing tools and strategies that have streamlined processes and enhanced decision-making capabilities. My success in leading the automation process and creating equity screening and performance reporting tools exemplifies my aptitude for identifying opportunities for improvement and implementing creative solutions.

Furthermore, I possess strong leadership and teamwork abilities, honed through my experiences as the captain of my college football team and as a lead equity analyst mentoring junior analysts. I have a proven track record of fostering collaborative environments, empowering team members, and effectively communicating complex ideas and strategies to diverse audiences.

Lastly, I am driven by an insatiable curiosity and a passion for continuous learning. My pursuit of the CFA Charter and my decision to apply for the Master of Finance program at MIT Sloan reflect my commitment to personal and professional growth, ensuring that I remain at the forefront of industry developments and contribute meaningfully to the advancement of knowledge and best practices.

By combining these personal qualities – ethical grounding, resilience, critical thinking, leadership, and a thirst for knowledge – with the world-class education and resources provided by MIT Sloan, I am confident in my ability to contribute to the institution’s mission of fostering principled, innovative leaders who improve the world.

Quick Essay Review

Worried if your Essay is Good enough or Not?

Need a last-minute review?

Submit your essays below & get in-depth feedback within 48 Hours.

MIT Sloan Winning Sample Essays – 2

Question 1: Please discuss your past academic and professional experiences and accomplishments that will help you succeed in the Master of Finance program. Include achievements in finance, math, statistics, and computer sciences, as applicable.

My academic journey began with a Bachelor of Commerce degree from Mangalore University, where I graduated with distinction, scoring 82.9%. This foundational education provided me with a strong grasp of finance and accounting principles. To deepen my expertise, I pursued and successfully completed the Chartered Accountant program from the Institute of Chartered Accountants of India (ICAI), clearing all levels on the first attempt. This rigorous training honed my analytical skills and fortified my understanding of complex financial concepts.

Professionally, I have accumulated over six years of diverse experience in finance, technology, and sustainability. I started my career at Odessa Technologies, where I worked as an Associate Finance Analyst and later as a Senior Finance Analyst. My role involved conducting detailed bug analysis, developing cost assessment models, and streamlining customer engagement processes. One notable achievement was leading a team that conducted a comprehensive bug analysis, which resulted in a $300k increase in company revenue. Additionally, I developed a cost center accounting and reporting model that reduced costs by 4% across 12 verticals.

In 2021, I transitioned to Updapt CSR, a tech startup focused on ESG (Environmental, Social, and Governance) solutions, where I currently serve as the Head of Product. Here, I spearheaded the development of India’s first ESG rating engine, which now rates over 1500 companies. I also led the creation of a private equity module for tracking ESG data, which is utilized by investment firms to report their impact in alignment with sustainability frameworks. My role required extensive use of statistical analysis and financial modeling to develop these products, demonstrating my proficiency in both finance and data analytics.

My professional journey has been marked by a continuous integration of finance, technology, and data analytics. At Updapt, I managed a 35-member team to design and launch the flagship product, Updapt ESG, which tracks, monitors, and reports over 750 ESG parameters for more than 70 companies. This experience underscores my ability to apply financial concepts to real-world problems, leveraging technology and data to drive strategic outcomes.

In addition to my professional achievements, I have been actively involved in community leadership. As a founding member of the Devi Charan Prabhu Memorial Charitable Trust, I organized events and training sessions that impacted over 200 children. This experience has refined my leadership and project management skills, further preparing me for the collaborative and dynamic environment of the MIT Sloan Master of Finance program.

My background in finance, coupled with my experience in technology and data analytics, provides a solid foundation for the Master of Finance program. My accomplishments in developing financial products, leading cross-functional teams, and driving strategic initiatives demonstrate my readiness to excel in this rigorous academic environment. I am confident that the Master of Finance program at MIT Sloan will build upon my existing knowledge and skills, enabling me to make meaningful contributions to the field of finance.

Question 2: Tell us about your short-term and long-term professional goals. How will our MFin degree help you achieve these goals?

In the short term, my professional goal is to transition into a strategic role within a leading private equity or venture capital firm, where I can leverage my expertise in financial analysis and ESG (Environmental, Social, and Governance) principles. My current role as Head of Product at Updapt CSR has given me invaluable experience in developing ESG frameworks and tools that are critical for investment decision-making. However, I recognize the need for advanced technical skills and a deeper understanding of financial strategies to excel in this field.

The Master of Finance (MFin) program at MIT Sloan is uniquely positioned to help me achieve these short-term goals. The program’s rigorous curriculum, which includes courses on investment strategies, corporate finance, and financial engineering, will provide me with a comprehensive understanding of advanced financial concepts. Additionally, the opportunity to engage with the MIT Sloan community and participate in initiatives like the Sloan Sustainability Initiative will deepen my knowledge of ESG factors and their impact on investment strategies. This will equip me with the skills necessary to drive sustainable investment decisions and influence the strategic direction of the firms I aim to work with.

In the long term, I aspire to establish my own impact-focused investment fund in India. This ambition is rooted in my early experiences with a rural microfinance institution, where I saw firsthand how finance and technology can alleviate hardships faced by the underserved. My goal is to create a fund that supports companies working on solutions to critical environmental and social challenges, thereby driving positive change and sustainable development.

The MFin program at MIT Sloan will be instrumental in helping me achieve this long-term goal. The program’s emphasis on experiential learning, such as the Action Learning Labs and the Finance Research Practicum, will provide me with practical insights into managing investment portfolios and understanding market dynamics. Furthermore, the program’s strong focus on entrepreneurship and innovation will equip me with the skills needed to launch and manage my own investment fund.

Moreover, the MIT Sloan alumni network will be an invaluable resource as I pursue my long-term ambitions. Connecting with successful entrepreneurs, investors, and finance professionals will provide mentorship and support, helping me navigate the challenges of starting an impact-focused fund. The program’s global perspective will also help me build a robust network within the international finance community, essential for attracting investment and fostering collaborations.

In summary, the Master of Finance program at MIT Sloan will provide the advanced technical knowledge, practical experience, and professional network necessary to achieve my short-term goal of transitioning into a strategic role within a leading investment firm and my long-term aspiration of establishing an impact-focused investment fund in India. I am excited about the opportunity to leverage MIT Sloan’s resources to drive sustainable investment and make a meaningful impact in the finance industry.

Question 3: What personal qualities will enable you to contribute to the advancement of our mission?

Several personal qualities will enable me to contribute effectively to the mission of MIT Sloan’s Master of Finance program. These qualities have been developed through my academic journey, professional experiences, and community involvement.

First and foremost, my commitment to continuous learning and adaptability has been a cornerstone of my personal and professional growth. As a Chartered Accountant, I embraced the rigorous demands of the program and cleared all levels on my first attempt, demonstrating my dedication and ability to excel in challenging environments. This commitment continued in my professional career, where I transitioned from traditional finance roles to a leadership position in an ESG tech startup. My ability to adapt to new roles and industries highlights my willingness to embrace change and continuously seek out opportunities for growth.

Another key quality is my strong analytical and problem-solving skills. In my role at Odessa Technologies, I led a detailed bug analysis project that identified significant resource optimization opportunities, resulting in a $300k increase in revenue. At Updapt CSR, I spearheaded the development of India’s first ESG rating engine and a private equity module for tracking ESG data. These accomplishments required a deep understanding of financial analysis, data analytics, and strategic planning, all of which are critical skills for advancing the mission of the MFin program.

Leadership and teamwork are also central to my professional identity. As Head of Product at Updapt, I have led cross-functional teams in developing innovative ESG solutions. My leadership was instrumental in scaling the company from 6 to over 100 employees and expanding our customer base to over 70 companies. Additionally, my community leadership roles, such as founding the Devi Charan Prabhu Memorial Charitable Trust, have further developed my ability to lead and inspire teams towards common goals.

My passion for sustainability and social impact aligns closely with the mission of MIT Sloan. I believe that finance has the power to drive positive change, and I am committed to leveraging my skills and experiences to advance sustainable and responsible investment practices. My work in developing ESG frameworks and tools at Updapt is a testament to this commitment, and I am eager to further this mission through the MFin program.

Finally, my ability to communicate effectively and build relationships will enable me to contribute to the collaborative and dynamic environment at MIT Sloan. Whether it was convincing the management team at Updapt to implement remote work solutions for a deserving candidate or engaging with community leaders to support educational initiatives, my communication skills have been crucial in driving successful outcomes. I am confident that these skills will help me collaborate effectively with peers, faculty, and industry professionals at MIT Sloan.

In conclusion, my commitment to continuous learning, strong analytical skills, leadership experience, passion for sustainability, and effective communication will enable me to contribute meaningfully to the Master of Finance program at MIT Sloan. I am excited about the opportunity to join this esteemed community and work towards advancing the program’s mission of developing principled, innovative leaders who improve the world.

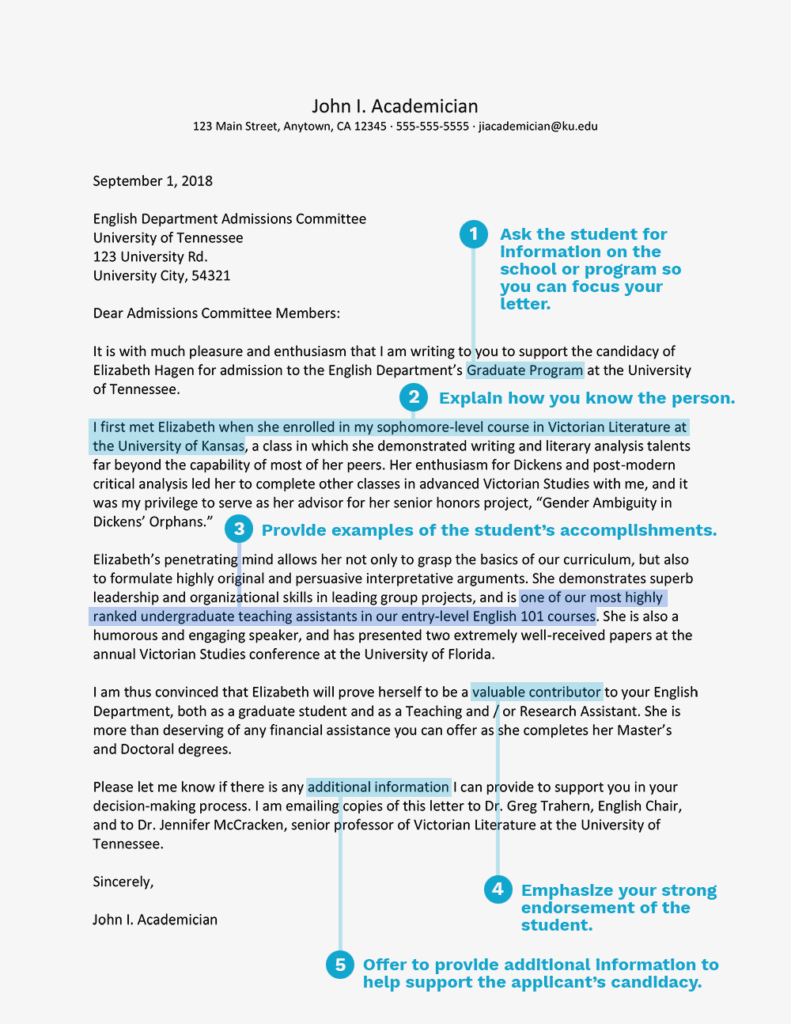

MIT Sloan Recommendation Letter – Key Questions

- How long and in what capacity have you known the applicant?

- How does the applicant stand out from others in a similar capacity?

- Please give an example of the applicant’s impact on a person, group, or organization.

- Please give a representative example of how the applicant interacts and communicates with others, including peers and superiors.

- Please give an example of how the applicant has synthesized and executed on an assigned task and/or mastered new material.

- Which of the applicant’s personal or professional characteristics would you change?

- Please tell us anything else you think we should know about this applicant.

MiF Recommendation Letters

(Free Samples & successful Examples)

Professor - Recommendation letter Sample 1

Here is a quick PDF of a sample recommendation our client submitted for a successful admit.

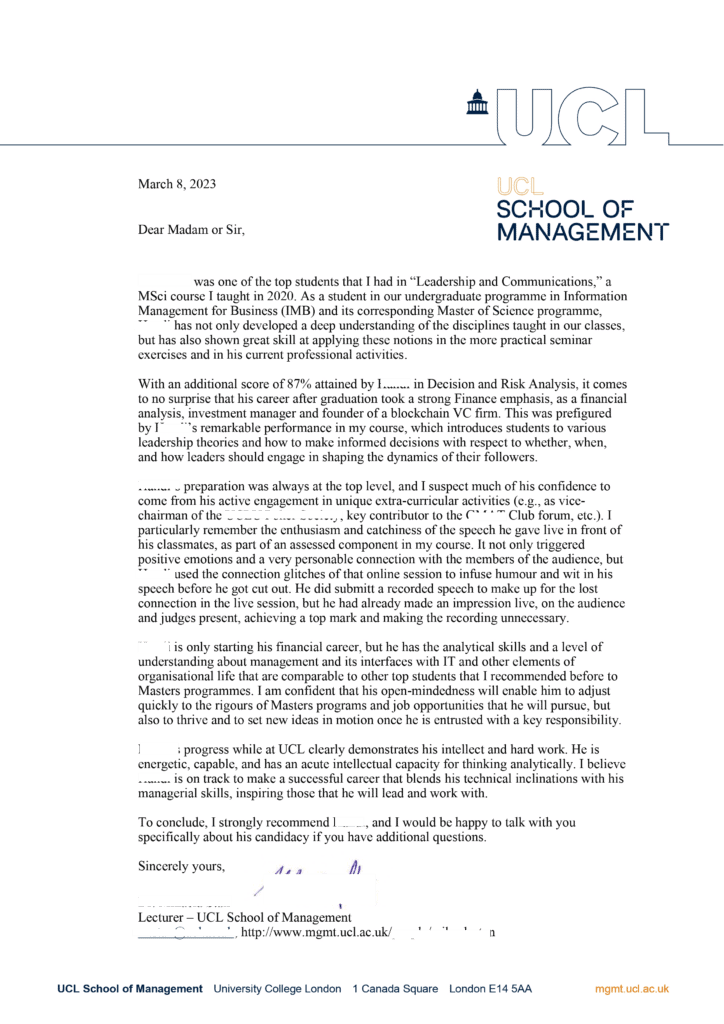

Professor - Recommendation letter Sample 2

To,

Admissions Committee

HEC Paris – Masters in Finance Program

Date: 08-09-2023

Subject: “Recommendation letter for Akhil’s application to MIF program at HEC Paris”

Dear Admissions Committee,

I have known Akhil for over 2 years now. He was a student in my Entrepreneurship course as part of his Minor in Entrepreneurship and Management. As a student in my class, Akhil showed great skill at applying these notions in the more practical in-class quizzes, his final group business pitch at the end of the course, and his professional activities at UBS. Akhil’s also had a remarkable performance in my course, in which Akhil got the highest grade possible of A+.

In terms of his potential,

Akhil stood out to me in the final project that I gave as part of the course evaluation. As a major assessment, I give a project assignment for students to work in groups and pitch a good, self-sustaining business idea.

Akhil took the initiative and created a multicultural and diverse team with students not only from different countries but also students from different majors and successfully delivered a group business pitch for a student-run laundry and cleaning business. The idea picked by his team was unique, and he actively sought my advice and mentorship to make the team and the project successful.

Another noteworthy facet is the analytical research done by Akhil before and after seeking my advice; he actively made an effort to learn about diverse topics that he had not been exposed to before and was successfully able to learn about the different aspects of entrepreneurship, such as management and finance. Demonstrating his goal and detail-oriented ability. Rhe idea, the data oriented research, and the financial analysis were really impressive (synthesized and executed on assigned taks). Also, the real-world considerations regarding the execution of the pitch, as well as the cohesive delivery from a team collaboration perspective, were good.

I liked the project, and I asked Akhil if I could include the pitch and presentation as teaching material for my course as well as offering a Research Assistant position to Akhil in the next summer, which he was unable to take due to him having graduated

With his analytical skills and his collaborative approach, it came to me as no surprise that he was able to successfully chase his goal and transition into finance directly from his undergrad in engineering, landing a role in finance with UBS in their Investment Banking Operations in Hong Kong.

In terms of his potential areas of Improvement

I think Akhil’s analytical nature and detail-orientedness sometimes leads to him getting too caught up in details and spending excess time on the intricate details, leading to improper time management.

In the group project, Akhil struggled with time management and was a week behind schedule for his group due to him giving equal attention to all the details of the presentation, losing track of the bigger picture of the project. With my guidance, he was able to get back on speed and submitted the project by the submission deadline. But I believe that Akhil needs to work on gaining a view of the overall project that he is working for better time management.

Overall Recommendation

Akhil is only starting his financial career, but he has the analytical skills and a level of understanding about management, teamwork and other elements of organizational life that are comparable to other top students that I recommended before to Masters programs.

Akhil’s progress at CityU and at UBS clearly demonstrates his intellect and hard work. He is capable and has an acute intellectual capacity for thinking analytically. I believe Akhil is on track to make a successful career that blends his quantitative inclinations with his qualititaive skills, inspiring those that he will lead and work with.

To conclude, I strongly recommend Akhil, and I would be happy to talk with you specifically about his candidacy if you have additional questions.

Regards

Professor XXXXXX

Head of the Department of Entrepreneurship and Management

XXXX University

Internship Manager - Recommendation Letter Sample 1

How long and in what capacity have you known the candidate?

I have known Pranav for roughly one and a half years. I was his mentor during his internship with UBS. Although he completed his internship and has moved on, we still continue to keep in touch to exchange different business ideas.

What do you think about the candidate’s professional performance and potential (including any room for improvement)?

When Pranav started his internship with UBS, he was one of the most proactive interns. Since he didn’t have a finance background, he showed keen interest in learning and came up the curve very quickly.

The team assigned him Automation and Efficiency-related projects, and while working in the automation team he managed to stand out from other interns by providing solutions that were slightly outside of the box and impressed everyone on the team.

For instance, he met with various team leads to understand their automation requirements and one team lead expressed her frustration with the manual risk report that used to take 10-12 hours every quarter. After the meeting, Pranav took the proactive step of helping automate this report for the team. The specific process automation that he implemented was for risk reports for the risk team. The team had a manual time consuming process in which they had to refer to multiple Excel sheets to create their quarterly risk report. Pranav understood and mapped the entire process before using an automation tool to automate it. This led to a time reduction of 90 percent in the compilation of the report. The automation process he designed was ingenious; no one had thought of using it before, and that is why I think everyone was impressed with his out-of-the-box thinking.

Apart from that, another one of his biggest strengths is his willingness to take initiative.

To highlight another instance, he noticed the dashboards in Operations and wider UBS were on Tableau, he took the initiative to compare Tableau and PowerBi and pitched shifting the employee statistics dashboard to PowerBi. The management team agreed and Pranav successfully created an Employee demographic dashboard on PowerBi. This led to cost savings for the department as UBS was already paying for PowerBi. He also took even more initiative, helping others in his team and UBS get certified on PowerBi and documented his knowledge for everyone before he left his internship.

On the flip side, when it comes to areas of improvement, I would also say this proactiveness and eagerness sometimes led to difficult situations. Like other fresh hires, he was also trying to prove himself in the initial months of his tenure with the team. However, this often meant that he would try to manage and solve things on his own instead of seeking help. This led to delays and situations becoming critical.

Pranav was tasked with getting certified on Automation Anywhere, another automation tool used by the team. He was unable to crack the certification according to the timeline assigned to him and was delayed by a month in getting certified. He tried to manage and solve the situation but was unable to do so without help from his team, this delay led to an increased workload for the rest of the team and longer hours as work had been earmarked for Pranav to do as soon as he would be finished with the certification.

Overall, I would say that Pranav has great potential; he is not afraid to take the initiative and present his ideas.

Regards

XXXXXX

Manager – UBS, Hong Kong Offices

Internship Manager - Recommendation Letter Sample 2

How do you know the applicant? How long have you known them for?

I have known Huang for almost 2 years now.

I came to know Huang when he was working at Chainfir Capital. I was an investor of the fund at Chainfir Capital. Huang worked as an investment manager at Chainfir and we had meetings together from time to time.

Later when Huang and his colleagues decided to start their own Venture Capital fund (Genesis 22) focused on crypto industry, I joined their venture both as an investor and an advisor of their VC Fund.

What would you say are the applicant’s key strengths and talents?

After working with Huang, I think one of his key talents is that he is very detail oriented and loves to perform extensive due diligence.

For instance, Genesis 22 was close to making an investment decision on a project called Glitter Finance last year. At the time, it was a rather popular project among VCs and had already received several investments. The analyst in our team provided positive comments on its technology and future potential.

Huang was responsible for speaking with the project team and conducting due diligence. He was able to approach the situation with a sceptical mind and later identified several risks of the project by paying attention to each detail. He made an analysis of the profile of each team member of the project and determined that the technical background of the team was not strong enough to develop the promising highly technical project they claimed. Also, he mentioned that while observing all the interaction between the founder of the project and individual investors in the community group, he noticed that the founder often gets angry easily when facing tough questions.

He raised these concerns during the investment decision meeting, and at the end of the meeting, we decided not to invest. A few months later – the project went bust because the value of the project was way inflated and every institutional investor suffered a loss. I am glad that Huang was able to pay close attention to such details and has always worked with great attention to achieve better performance.

Another key talent of Huang is his multi-tasking skills. I am really impressed by his performance in dealing with a variety of projects simultaneously. When he works as an investment manager in the team, he needs to handle the communication and investigation with 5-8 projects at the same time. He has never left others waiting for his work, and we can always set up the evaluation meeting in the anticipated time frame. He is also able to deal with the pressure when there are extra projects which need his attention.

What would you say are the applicant’s key weaknesses or areas for improvement?

As the founder of a venture capital firm, Huang has built a team and became a leader at such a young age. But I think there is still room for improvement in his management skills, especially in delegating workload.

As Huang prefers to participate in every stage of the investment decision of a certain project, it limits the overall number of projects he can oversee. For example, he spent much time on initial screening and understanding complex technology concepts of different projects. In my opinion, he could delegate this work and trust his colleagues to complete these tasks as our analysts with technology backgrounds are capable of determining the technology feasibility so that he can invest most of his time in reviewing the big picture.

Second thing I have asked him to improve upon is that he can sometimes be over-optimistic and confident when things are going well. From my perspective, it is crucial to keep a cool mind when dealing with different market situations. When he started Genesis 22, several investments that we made looked promising. Consequently, he was on the aggressive side to allocate a higher proportion of the fund to such projects. However, when there was a change in the market trend and crypto industry started crashing, some investments did not perform as well as we expected. The fund suffered extra losses because of the higher allocation made to these investments.

Huang realized his mistake afterwards and became more cautious in making an allocation to investments to improve the diversification of the portfolio. I hope he has learned his lesson and does not repeat the same mistake again.

In which areas of development has the applicant progressed most in the time you’ve known them?

Overall the one big area where I think Huang has really improved is his ability to find and initiate business opportunities and partnerships.

When he started Genesis 22 Ventures, His venture was not receiving stable cash flow except for the return on the investments. He or his patterns did not know that a venture capital fund can expand its business through partnerships and pitching good projects to other VC firms. This way they can build a revenue stream based on commission without risking their own money.

When I brought this up to him, he learned the rules quickly. He has put in great effort in communicating with other VCs to understand how others operate and create business ideas. The first few times when I had meetings with Huang he could only interpret the general basics of the start-up projects. Therefore, he was not able to provide insightful opinions in decision making. After Huang talked to many teams and spent much time reading industry news, I observed that he was getting better and better at describing business models of different projects in a big picture. Although Huang doesn’t have a strong technology background, he is able to integrate the work of analysts into his knowledge and present a blockchain project in a big picture smoothly.

Through partnerships and advisory services, Huang has helped the venture generate around $40,000 in extra revenue. Genesis 22 has expanded its services to crypto exchange listing consulting, funding advisory and community management for startup projects, etc.

I have seen him learn and grow and I think Huang has progressed massively in his commercial awareness.

If you are a professional referee, would you work with the applicant again post-Masters in Financial Analysis?

Absolutely. Although his fund currently suffers a drop in the quality of deal flow given the bearish situation of the blockchain market, he has made the right decision to make very few investments recently based on the interests of investors. I respect his decision to pursue a master’s in finance degree, and if he wants to resume his Venture Capital firm full-time or work at my VC in the future I would love to work with him again.

Do's & Don'ts - of a Recommendation Letter

Do’s:

Choose the Right Recommender:

- Select someone who knows you well, can speak to your professional skills and achievements, and can provide detailed and specific examples of your work. Current or past supervisors, clients, or mentors who have worked closely with you are ideal choices.

Provide Specific Examples:

- Ensure the recommender includes specific examples of your accomplishments, skills, and experiences. This makes the recommendation more credible and impactful. Detailed anecdotes and quantifiable achievements are particularly effective.

Meet with Your Recommender:

- Schedule a meeting with your recommender to discuss your goals, achievements, and reasons for pursuing an MBA. Provide them with a detailed résumé and a list of your accomplishments to help them write a thorough and personalized letter.

Ensure Timely Submission:

- Set a personal deadline for your recommenders that is well ahead of the actual application deadline. This helps ensure that your letters are submitted on time and reduces last-minute stress.

Highlight Strengths and Areas for Growth:

- Encourage your recommender to provide a balanced view by mentioning your strengths along with areas for growth. Constructive feedback adds credibility and shows your willingness to improve.

Don’ts:

Don’t Write Your Own Recommendation:

- Never write your own letter of recommendation, even if a recommender suggests it. Admissions committees can easily detect self-written letters, which can harm your application.

Don’t Choose Recommenders Based on Title Alone:

- Avoid selecting recommenders solely based on their impressive titles or positions if they do not know you well. A letter from a CEO or politician who has minimal interaction with you is less effective than one from someone who can provide detailed insights into your work and character.

Don’t Use Generic Praise:

- Ensure your recommender avoids using vague, generic praise without backing it up with specific examples. Statements like “She is a great employee” are less impactful than detailed anecdotes that illustrate why you are exceptional.

Don’t Ignore the Application Instructions:

- Make sure your recommenders follow the specific instructions and format required by each business school. Different schools may have varying requirements, and it’s important to adhere to them.

Don’t Overload with Superlatives:

- Encourage your recommender to be honest and avoid excessive use of superlatives. Over-the-top praise without substance can seem insincere. Balanced, realistic assessments that highlight genuine strengths and achievements are more effective.

These do’s and don’ts will help ensure that the letters of recommendation are strong, credible, and supportive of your MBA application.

Free Sample Template - for you to Use

Here’s is a quick template tailored for candidates applying to a Master’s in Finance program:

—

Admissions Committee

[Finance Program Name]

[University Name]

[University Address]

[City, State, ZIP Code]

[Date]

Subject: “Letter of recommendation for [Candidate’s Name]”

Dear Members of the Admissions Committee,

I am pleased to write this letter of recommendation for [Candidate’s Name]. I have had the pleasure of working with [Candidate’s Name] at [Company Name] for [duration], where I serve as [Recommender’s Title]. In my capacity, I have directly supervised [Candidate’s Name] and have gained a thorough understanding of their professional capabilities and character, particularly in the field of finance.

Specific Examples of Performance and Achievements

[Candidate’s Name] has consistently demonstrated exceptional [skills/qualities] in finance. For example, in [specific project/task], [Candidate’s Name] [specific action taken], which resulted in [quantifiable result/outcome]. This achievement is indicative of [Candidate’s Name]’s [particular quality, e.g., analytical skills, financial modeling, risk management].

Another instance of [Candidate’s Name]’s capabilities was during [another specific project/task]. Here, [Candidate’s Name] [specific action taken], leading to [quantifiable result/outcome]. This project highlighted [Candidate’s Name]’s ability to [related skills, e.g., manage financial portfolios, conduct market analysis, handle complex financial challenges].

Constructive Feedback and Areas of Improvement

During our time working together, I provided [Candidate’s Name] with constructive feedback on [specific area for improvement]. In response, [Candidate’s Name] [specific actions taken to improve]. This demonstrated their openness to feedback and commitment to personal and professional growth in the financial sector.

Leadership Skills and Team Inclusiveness

[Candidate’s Name] is known for their inclusiveness and encouragement of others. For example, during [specific instance], [Candidate’s Name] [specific actions taken to include and encourage others]. This behavior fostered a collaborative and supportive work environment and showcased their leadership and interpersonal skills.

Conclusion and Endorsement

In conclusion, I wholeheartedly endorse [Candidate’s Name] for the [Master’s in Finance program] at [University Name]. I am confident that [Candidate’s Name]’s [specific strengths/qualities] will be an asset to your program and that they will thrive in the academically rigorous and collaborative environment of [University Name].

Please feel free to contact me at [Recommender’s Email] or [Recommender’s Phone Number] if you require any further information.

Sincerely,

[Recommender’s Name]

[Recommender’s Title]

[Company Name]